Third Party Pension Administration Software Market

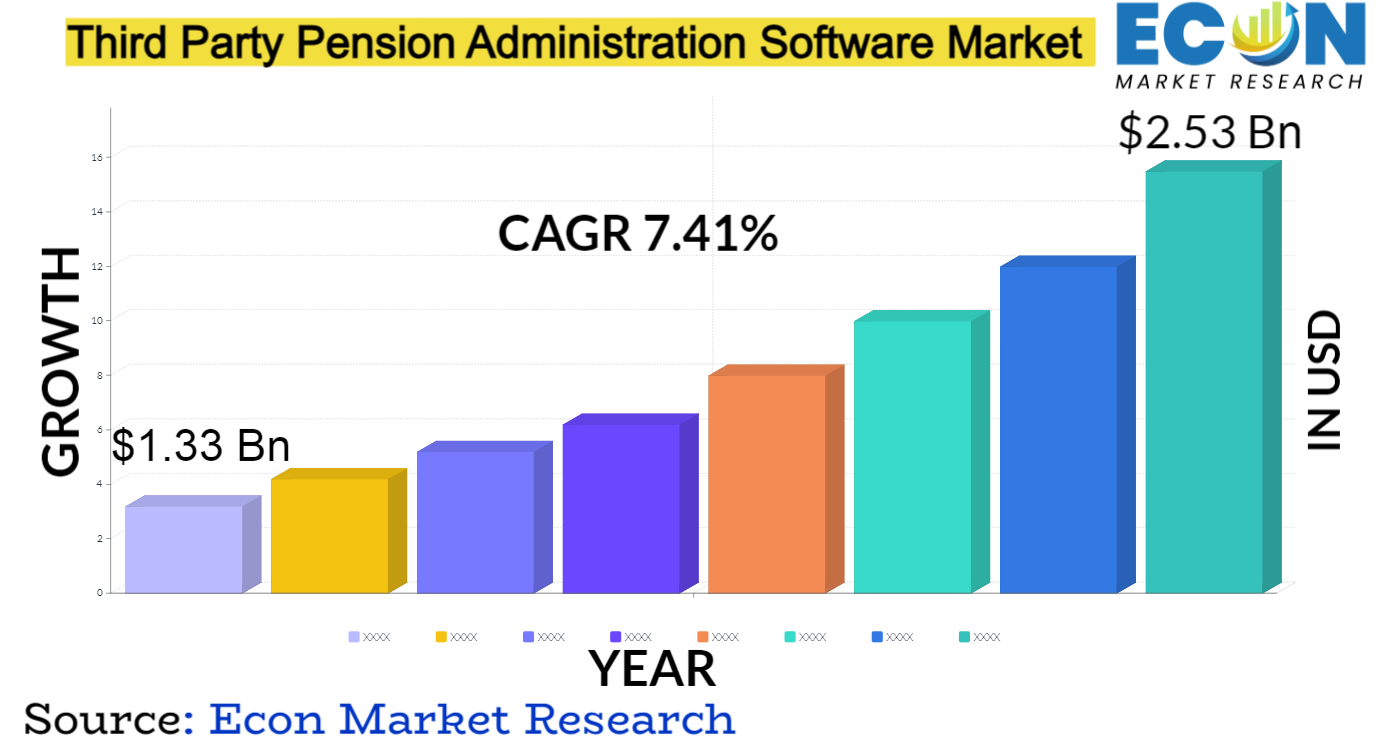

Global Third Party Pension Administration Software market is predicted to reach approximately USD 2.53 billion by 2032, at a CAGR of 7.41% from 2024 to 2032.

The Global Third Party Pension Administration Software market refers to the industry segment dedicated to software solutions that facilitate the management and administration of pension funds by third-party providers. These software platforms offer comprehensive tools for handling various aspects of pension administration, including member enrolment, contribution processing, investment management, regulatory compliance, and reporting. With the increasing complexity of pension schemes and the need for efficient management, third-party pension administration software has become indispensable for pension providers, employers, and plan participants worldwide.

In recent years, the Global Third Party Pension Administration Software market has experienced significant growth due to several factors. The rising adoption of defined contribution pension plans, coupled with the shift away from traditional defined benefit plans, has spurred the demand for sophisticated software solutions capable of managing diverse investment portfolios and member accounts. Further, regulatory changes and compliance requirements have necessitated the implementation of robust software platforms that can ensure adherence to stringent pension regulations and reporting standards across different jurisdictions.

Additionally, the growing focus on enhancing operational efficiency and reducing administrative costs has prompted pension providers to invest in innovative software solutions that streamline processes, automate routine tasks, and enhance overall productivity. Moreover, the increasing trend towards digitalization and the emergence of cloud-based technologies have further fuelled the demand for flexible, scalable, and secure pension administration software solutions that can adapt to evolving business needs and regulatory landscapes.

Third Party Pension Administration Software Report Scope and Segmentation

| Report Attribute | Details |

| Estimated Market Value (2023) | USD 1.33 billion |

| Projected Market Value (2032) | USD 2.53 billion |

| Base Year | 2023 |

| Forecast Years | 2024 &ndash, 2032 |

| Scope of the Report | Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment- Based on By End-user Industry, By Functionality, By Deployment Model, By Organization Size &, Region. |

| Segments Covered | By By End-user Industry, By Functionality, By Deployment Model, By Organization Size, &, By Region. |

| Forecast Units | Value (USD Billion or Million), and Volume (Units) |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2024 to 2032. |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East &, Africa. |

| Countries Covered | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, and South Africa, among others. |

| Report Coverage | Market growth drivers, restraints, opportunities, Porter&rsquo,s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, market attractiveness analysis by segments and region, company market share analysis. |

| Delivery Format | Delivered as an attached PDF and Excel through email, according to the purchase option. |

Third Party Pension Administration Software Dynamics

One key driver is the increasing need for pension providers and employers to mode ize their administration systems to cope with the complexities of evolving regulatory environments and demographic shifts. As regulatory requirements become more stringent and diverse across different regions, there is a growing demand for software solutions that can ensure compliance while offering flexibility and scalability to adapt to changing regulatory landscapes.

Furthermore, the market is witnessing a shift towards digitalization and automation, fuelled by the growing recognition of the benefits of technology in improving operational efficiency and reducing administrative overheads. Pension providers are increasingly embracing cloud-based solutions and leveraging advanced analytics capabilities to enhance decision-making processes, optimize investment strategies, and personalize member experiences. Moreover, the rise of mobile technologies and self-service portals is empowering plan participants with greater visibility and control over their pension accounts, driving the demand for user-friendly and intuitive software interfaces.

However, the market also faces challenges such as data security conce s, legacy system integration issues, and the complexity of pension fund structures, which require sophisticated software solutions capable of handling diverse investment portfolios and member accounts. Nevertheless, with the continued expansion of pension schemes globally and the growing emphasis on retirement savings, the demand for third-party pension administration software is expected to remain robust, presenting ample opportunities for vendors to innovate and differentiate themselves in an increasingly competitive landscape.

Third Party Pension Administration Software Drivers

- Regulatory Compliance Requirements:

The stringent regulatory environment surrounding pension administration is a significant driver for the Third Party Pension Administration Software market. Regulatory bodies impose complex rules and reporting standards that necessitate advanced software solutions to ensure compliance. Pension providers are under pressure to adhere to regulations related to data security, privacy, transparency, and financial reporting.

As regulations evolve and become more stringent, the demand for software platforms capable of automating compliance tasks, generating accurate reports, and maintaining audit trails continues to rise. This driver compels pension providers to invest in sophisticated software solutions that can adapt to regulatory changes, minimize compliance risks, and enhance operational efficiency.

- Digital Transformation and Automation:

The increasing trend towards digitalization and automation across industries is another significant driver for the Third Party Pension Administration Software market. Pension providers are embracing digital technologies to streamline administrative processes, reduce manual errors, and improve overall efficiency. Automation features such as member enrollment, contribution processing, investment tracking, and reporting enable pension providers to optimize resource allocation, lower operational costs, and enhance service delivery.

Moreover, digital platforms offer plan participants greater transparency, accessibility, and control over their pension accounts, driving demand for user-friendly interfaces and mobile applications. As pension providers seek to mode ize their operations and enhance customer experiences, the demand for advanced software solutions that support digital transformation initiatives continues to grow, fuelling market expansion.

Restraints:

- Data Security Conce s:

There are major barriers to the Third Party Pension Administration Software market, including conce s about data security and privacy. Pension providers are often the focus of cyberattacks and data breaches because they manage the private and financial information of plan participants. Adoption of cloud-based software solutions is hampered by worries about data security, integrity, and confidentiality, which call for strong security measures to protect sensitive data. Pension providers', efforts to comply with regulations like the CCPA and GDPR are further complicated by the strict obligations placed on data protection.

- Legacy System Integration Challenges:

Legacy system integration challenges represent another restraint for the Third Party Pension Administration Software market. Many pension providers operate on outdated legacy systems that lack interoperability and scalability, making it difficult to integrate mode software solutions seamlessly. Legacy systems often involve complex data migration processes, customization requirements, and compatibility issues, leading to prolonged implementation timelines and increased costs. Moreover, legacy systems may lack the advanced features and functionalities required to meet evolving business needs and regulatory requirements, hindering the adoption of mode software platforms.

Opportunities:

- Integration of Advanced Technologies:

The integration of advanced technologies such as artificial intelligence (AI), machine lea ing (ML), blockchain, and predictive analytics presents exciting opportunities for innovation and differentiation in the Third Party Pension Administration Software market. AI and ML algorithms can analyse vast amounts of data to identify trends, detect anomalies, and optimize investment strategies, enhancing decision-making processes and performance outcomes. Blockchain technology offers transparent and secure transaction processing, enabling immutable record-keeping and streamlined regulatory compliance.

Predictive analytics tools enable pension providers to anticipate future trends, assess risk exposures, and personalize investment portfolios based on individual preferences and goals. By leveraging these advanced technologies, software vendors can offer cutting-edge solutions that deliver enhanced value propositions, drive operational efficiencies, and foster greater trust and transparency in pension administration.

Segment Overview

- By End-User

End-user industries encompass Banking, Financial Services, and Insurance (BFSI), Healthcare, Manufacturing, Gove ment, and others. The BFSI sector, known for its complex pension schemes and regulatory requirements, relies heavily on robust software solutions for efficient pension fund management. Healthcare organizations seek software platforms to administer pension plans for their employees, ensuring compliance and accuracy in calculations. Similarly, manufacturing and gove ment sectors utilize pension administration software to handle employee retirement benefits seamlessly. Other industries, including retail, education, and hospitality, also leverage these solutions to manage their pension programs effectively.

- By Functionality

In terms of functionality, pension administration software offers a range of features including Contribution Management, Pension Calculation, Investment Management, Compliance Management, and Reporting and Analytics. These functionalities empower pension providers to streamline processes, automate calculations, optimize investment strategies, ensure regulatory compliance, and generate insightful reports for informed decision-making.

- By Deployment

Deployment models for pension administration software include Public Cloud, Private Cloud, and Hybrid Cloud solutions. Public Cloud deployment offers scalability, cost-effectiveness, and accessibility, making it popular among small and medium enterprises (SMEs) seeking flexible and affordable solutions. Private Cloud deployment provides enhanced security and customization options, catering to the stringent data privacy requirements of large enterprises and organizations with sensitive data. Hybrid Cloud deployment combines the benefits of both public and private clouds, allowing organizations to leverage on-premises infrastructure while ha essing the scalability and agility of the cloud.

- By Organization Size

The market serves organizations of varying sizes, including Small and Medium Enterprises (SMEs) and Large Enterprises. SMEs benefit from scalable and cost-effective solutions that meet their budgetary constraints and operational requirements. Large enterprises, with complex pension portfolios and extensive workforce, require scalable, customizable, and feature-rich software platforms to manage their pension administration processes effectively.

Third Party Pension Administration Software Overview by Region

North America leads the market, driven by the presence of established pension systems, stringent regulatory requirements, and a high concentration of pension providers and financial institutions. The region witnesses robust demand for advanced software solutions capable of addressing complex pension schemes, compliance challenges, and evolving customer needs.

Europe follows suit, propelled by regulatory reforms, demographic shifts, and the growing emphasis on retirement savings. Countries such as the UK, Germany, and the Netherlands exhibit strong demand for pension administration software, fueled by pension reforms, digital transformation initiatives, and the proliferation of defined contribution plans. ,In the Asia Pacific region, rapid urbanization, rising disposable incomes, and evolving regulatory landscapes drive the adoption of third-party pension administration software. Countries like China, India, and Australia witness significant market growth, driven by gove ment initiatives to promote retirement savings, expand pension coverage, and enhance financial literacy.

Moreover, the increasing penetration of digital technologies, the emergence of fintech startups, and the growing awareness of retirement planning contribute to market expansion in the region. Latin America and the Middle East &, Africa regions represent emerging markets with untapped growth potential. These regions witness increasing adoption of pension administration software driven by economic development, regulatory reforms, and the expansion of pension coverage. However, market growth in these regions is hindered by challenges such as limited access to financial services, regulatory complexities, and socio-economic disparities.

Third Party Pension Administration Software Market Competitive Landscape

Leading vendors such as SS&,C Technologies Holdings, Inc., FIS, Oracle Corporation, and IBM Corporation dominate the market with their comprehensive suite of software solutions catering to diverse end-user industries and regulatory environments. These players focus on enhancing product functionalities, integrating advanced technologies, and improving user experience to gain a competitive edge in the market. Moreover, strategic acquisitions, mergers, and collaborations are common strategies adopted by key players to strengthen their market presence, expand their customer base, and enter new geographic markets.

Furthermore, emerging players and niche vendors are disrupting the market with innovative solutions tailored to specific market segments, industry verticals, or regional requirements. These players leverage agile development methodologies, cloud-based architectures, and scalable platforms to offer cost-effective and flexible alte atives to traditional incumbents. Additionally, startups and fintech companies are entering the market with disruptive business models, leveraging technologies such as artificial intelligence, machine lea ing, and blockchain to address emerging challenges and opportunities in pension administration.

Third Party Pension Administration Software Market Leading Companies:

,

-

Heywood Limited

-

Milliman, Inc.

-

SAP SE

-

Oracle Corporation

-

Capita plc

-

The Civica Group

-

Equiniti Group plc

-

Sagitec Solutions

-

Buck Global, LLC

-

Smart Pension Limited

Global Third Party Pension Administration Software Report Segmentation

| ATTRIBUTE | , , , , ,DETAILS |

| By End-user Industry |

|

| By Functionality |

|

| By Deployment Model |

|

| By Organization Size |

|

| By Geography |

|

| Customization Scope |

|

| Pricing |

|

,

FAQs

Report Details

- Last UpdatedJanuary 31, 2026

- FormatPDF

- LanguageEnglish