Spray Dryer Market

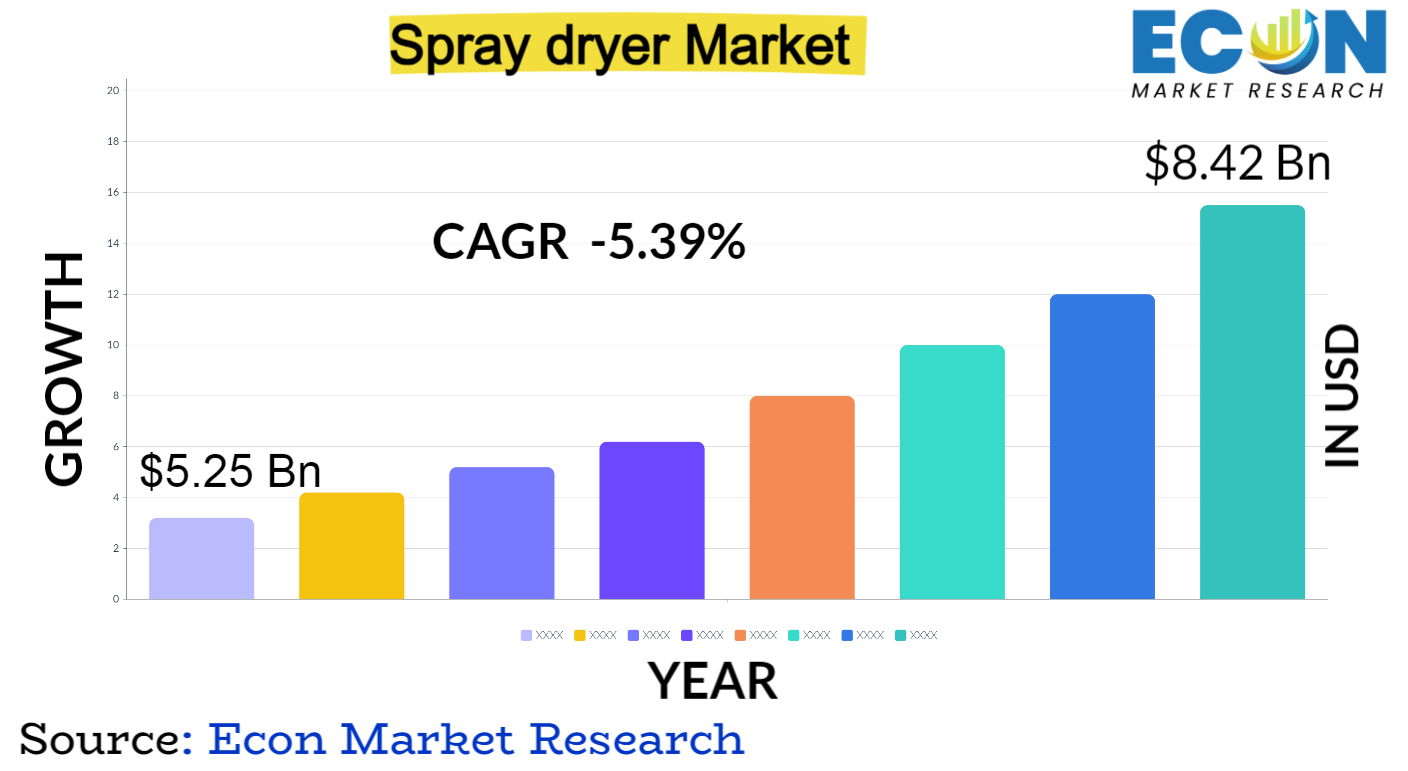

Global Spray Dryer Market is predicted to reach approximately USD 8.42 billion by 2032, at a CAGR of 5.39% from 2024 to 2032.

A spray dryer is a crucial industrial equipment that facilitates the conversion of liquid or slurry substances into powder form through the process of atomization and drying. This technique finds extensive applications in sectors such as food and beverages, pharmaceuticals, chemicals, and ceramics, among others. The demand for spray dryers is primarily driven by the increasing need for efficient and cost-effective powder production, where the preservation of product properties and characteristics is essential.

Spray Dryer Report Scope and Segmentation

| Report Attribute | Details |

| Estimated Market Value (2023) | USD 5.25 billion |

| Projected Market Value (2032) | USD 8.42 billion |

| Base Year | 2023 |

| Forecast Years | 2024 &ndash, 2032 |

| Scope of the Report | Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment- Based on By Type, By Application, Drying Stage &, Region. |

| Segments Covered | By Type, By Application, Drying Stage &, By Region. |

| Forecast Units | Value (USD Billion or Million), and Volume (Units) |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2023 to 2032. |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East &, Africa. |

| Countries Covered | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, and South Africa, among others. |

| Report Coverage | Market growth drivers, restraints, opportunities, Porter&rsquo,s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, market attractiveness analysis by segments and region, company market share analysis. |

| Delivery Format | Delivered as an attached PDF and Excel through email, according to the purchase option. |

Spray Dryer Dynamics

The driver is the increasing demand for processed and convenience foods, prompting the food and beverage industry to extensively adopt spray drying technology for the production of powdered ingredients, flavourings, and nutritional supplements. The pharmaceutical sector also contributes significantly to the market dynamics, driven by the growing need for advanced drug formulations with improved bioavailability and stability.

Technological developments also have an effect on the market, for example, continuous research and development efforts aim to improve the sustainability and efficiency of spray drying procedures. The industry is undergoing a revolution thanks to innovations like automation and the integration of smart sensors, which allow manufacturers to reduce energy consumption and increase precision and control over their operations. As industries prioritise eco-friendly solutions, the ongoing pursuit of environmentally friendly practices and the adoption of sustainable technologies are emerging as critical influencers in the dynamics of the market.

Spray Dryer Drivers

- Rising Demand for Processed Foods

One of the primary drivers of the global spray dryer market is the escalating demand for processed and convenience foods worldwide. The food and beverage industry extensively employs spray drying technology for converting liquid food concentrates into easily transportable and storable powdered forms. This not only enhances the shelf life of products but also facilitates efficient handling and distribution. As consumer preferences shift towards convenient and ready-to-use food products, the demand for spray dryers continues to grow, positioning the market for sustained expansion.

- Technological Advancements and Automation

The market is significantly driven by the ongoing evolution of spray drying technology brought about by automation and technological advancements. In order to provide real-time monitoring, precise control, and enhanced operational efficiency, manufacturers are incorporating automation solutions, control systems, and smart sensors into spray drying processes. This improves product consistency and quality while also consuming less energy. As a result of the adoption of cutting-edge technologies and the search for novel ways to solve environmental issues and boost overall process efficiency, the spray dryer market is expanding.

Restraints:

The high initial cost of spray drying system setup and installation is a significant barrier to the market for spray dryers. High capital expenditures are a result of these systems', complexity as well as the requirement for automation, cutting-edge technologies, and quality control procedures. These up-front expenses could be difficult for small and medium-sized businesses to afford, which would restrict their ability to use spray drying technology. One obstacle is the high cost of entry into this market, especially for companies with limited resources.

- Energy Consumption and Environmental Conce s

Energy consumption remains a critical restraint for the spray dryer market. The process involves the atomization of liquid feed into droplets and subsequent drying, requiring substantial energy inputs. High energy consumption not only contributes to operational costs but also raises environmental conce s related to carbon emissions. As sustainability becomes a key focus for industries, addressing the energy efficiency of spray drying processes is essential. Manufacturers are under increasing pressure to develop solutions that minimize environmental impact while maintaining cost-effectiveness.

Opportunities:

- Health and Wellness Trends

The market for spray dryers has a lot of potential because of the increased emphasis on health and wellness around the world. Demand for nutritious and useful ingredients in food and pharmaceutical products is rising as consumers grow more health-conscious. In line with current health and wellness trends, spray drying makes it easier to incorporate vitamins, probiotics, and other bioactive ingredients into powdered formulations. Manufacturers can take advantage of this by creating cutting-edge goods that satisfy consumers', changing dietary and lifestyle preferences.

Segment Overview

- By Type

The market for spray dryers is complex, with many different segments serving various industrial requirements. The atomization methods market is divided into different categories. Rotating discs are used in rotary atomizers to disperse droplets, providing a range of droplet sizes for use in chemical, pharmaceutical, and food applications. Nozzle atomizers are used in the chemical and pharmaceutical industries because they provide accurate control over droplet size. For better heat transfer, fluidized spray dryers employ a fluidized bed, making them appropriate for granulation in goods like instant coffee. Spray dryers with closed loops are made to be environmentally friendly. They recycle drying gases in order to comply with strict regulations. Large-scale industrial settings use centrifugal spray dryers, which are powered by centrifugal force and have a high capacity.

- By Drying Stages

In terms of drying stages, the market offers single-stage spray dryers, suitable for straightforward drying needs. Two-stage spray dryers provide more control over temperature and residence time, ideal for sensitive products. Multi-stage spray dryers offer flexibility for complex processes and specific product formulations. These drying stage categories address varying requirements in the drying process, catering to a range of product characteristics.

- By Application ,

Application-based segmentation reflects the industries leveraging spray drying technology. In the food and dairy sector, spray dryers preserve nutritional content and flavor in products like milk powder and coffee. The pharmaceutical industry utilizes the technology for drug formulation, ensuring precise particle control for improved delivery. The chemical industry benefits from spray drying in producing catalysts and specialty products.

Additionally, spray dryers play a role in animal feed production, creating stable and enriched feed powders. These application segments showcase the versatility of spray drying technology across diverse industries, addressing specific production needs. In essence, the spray dryer market',s segmentation strategy allows for a nuanced understanding of the technology',s varied applications, enabling manufacturers to tailor solutions to specific industrial requirements.

Spray Dryer Overview by Region

North America, with its robust food and pharmaceutical industries, stands as a prominent market driver. The region',s commitment to technological innovation and stringent quality standards fosters the adoption of advanced spray drying solutions. Europe follows suit, with a strong presence in the pharmaceutical sector and a growing emphasis on sustainable manufacturing practices, propelling the demand for efficient spray drying technologies.

Due to the region',s rapid industrialization, urbanisation, and rising demand for processed foods from consumers, Asia-Pacific is emerging as a key growth area. Spray drying is widely used in a variety of industries, including food and chemicals, in nations like China and India. The growing pharmaceutical industry in the area supports market expansion. Untapped potential exists in Latin America, the Middle East, and Africa due to economic growth and increased investments in the production of food and pharmaceuticals. However, factors like infrastructure development, legal frameworks, and technological awareness affect market growth in these areas.

Spray Dryer Market Competitive Landscape

Leading companies such as GEA Group AG, SPX FLOW, and Dedert Corporation are actively involved in the development of advanced spray drying technologies and systems. These companies emphasize continuous research and development to enhance the efficiency, automation, and sustainability of their products, addressing the evolving needs of diverse industries.

Collaborations and partnerships play a crucial role in the competitive strategies of market players. Companies often engage in strategic alliances with research institutions and universities to leverage expertise and stay at the forefront of technological advancements. Additionally, partnerships with end-user industries enable manufacturers to tailor their solutions to specific application requirements, strengthening their market presence.

Spray Dryer Market Leading Companies:

-

GEA Group AG

-

SPX Flow

-

Bü,chi Labortechnik AG

-

Yamato Scientific Co., Ltd.

-

Dedert Corporation

-

Changzhou Lemar Drying Engineering Co., Ltd.

-

Acmefil Engineering Systems Pvt. Ltd.

-

Shandong Shungeng Drying Equipment Co., Ltd.

-

AVM Systech Pvt. Ltd.

-

European SprayDry Technologies (ESDT) Ltd.

Spray Dryer Recent Developments

- Feb 2023, EUROAPI has unveiled the introduction of a state-of-the-art spray dryer at its Research and Development facility in Haverhill, United Kingdom. This initiative aims to bolster the company',s capabilities in advancing and expanding pharmaceutical processes for its clients in the Contract and Development Manufacturing Organization (CDMO) sector. The recently introduced spray dryer will be at the disposal of projects involving chemical and biochemical synthesis conducted across EUROAPI',s various sites in France, Germany, Italy, and Hungary.

- April 2023, RELCO, a Koch Separation Solutions subsidiary, has introduced the Parvus pilot spray dryer tailored for various food applications. This system comes in two variants: the Parvus Nomad, a single-stage dryer ideal for trial batches and smaller production volumes (up to 10 kg or 22 lb of water evaporation), and the Parvus Multi-Stage dryer, featuring a broad design to accommodate larger production volumes (up to 25 kg or 55 lb of water evaporation). The pilot spray dryer is designed to provide customers with complete flexibility for initial testing and future scalability. It also has the capability to seamlessly integrate with other pilot technologies, generating valuable data for comprehensive full-scale planning. ,

Global Spray Dryer Report Segmentation

| ATTRIBUTE | , , , , DETAILS |

| By Type , |

|

| By Drying Stage |

|

| By Application |

|

| By Geography |

|

| Customization Scope |

|

| Pricing |

|

,

Report Details

- Published Date2024-12-22T15:59:46

- FormatPDF

- LanguageEnglish