Orthopedic Devices Market

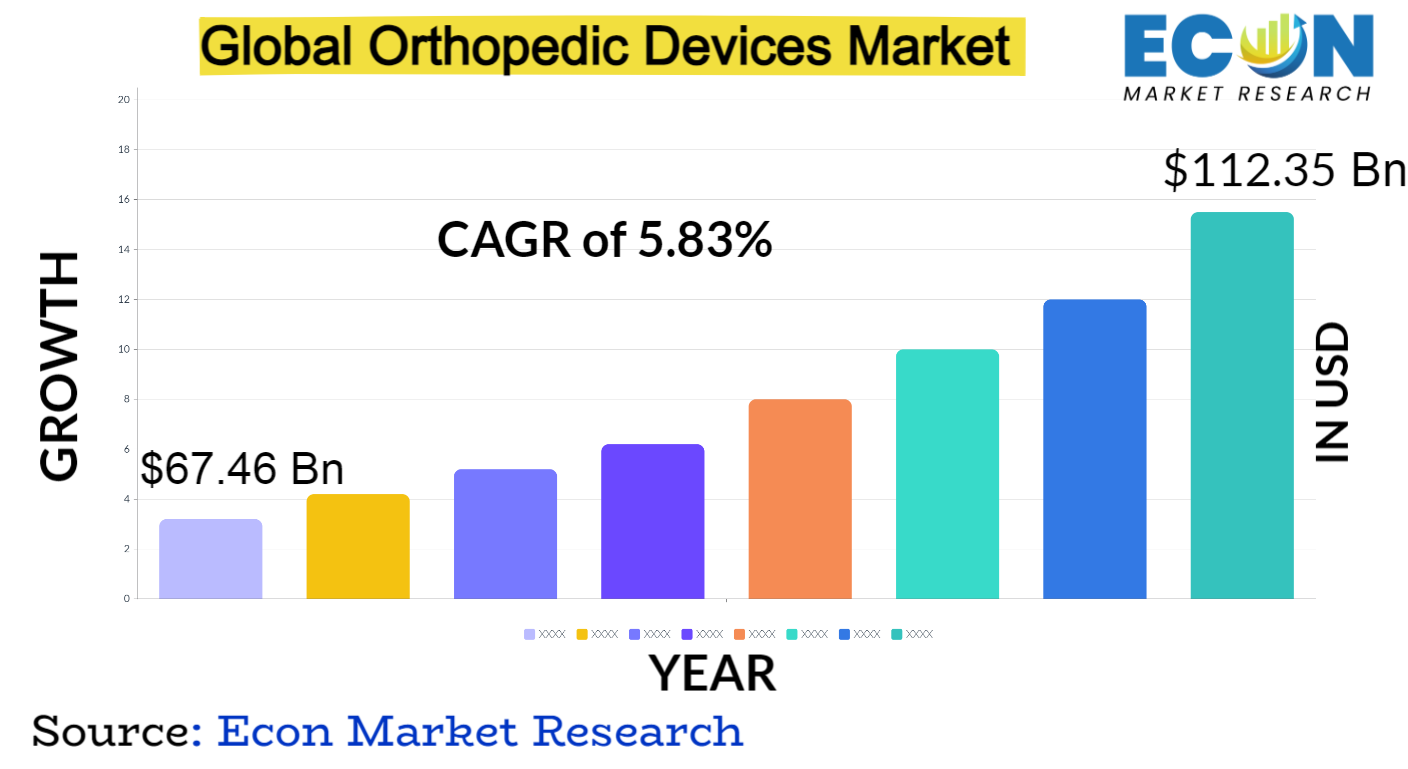

Orthopedic Devices Market is predicted to reach approximately USD 112.35 billion by 2031, at a CAGR of 5.83% from 2022 to 2031.

The global orthopedic devices market refers to the vast industry dedicated to the development, manufacturing, and distribution of medical devices designed to treat musculoskeletal conditions and disorders. These conditions encompass a wide range of issues, including fractures, arthritis, soft tissue injuries, and degenerative diseases affecting bones and joints. Orthopedic devices play a crucial role in restoring mobility, alleviating pain, and improving the overall quality of life for individuals affected by these musculoskeletal conditions.

The market is driven by technological advancements in medicine, an ageing population, and the rising incidence of orthopaedic disorders. Orthobiologics, joint implants, orthopaedic braces and supports, arthroscopy equipment, and trauma fixation equipment are important orthopaedic devices. Because osteoarthritis and age-related degeneration are increasing the need for joint reconstruction, joint implants&mdash,such as hip and knee replacements&mdash,are especially important. The orthobiologics segment, involving the use of biological materials to stimulate healing, has witnessed notable innovation and adoption.

| Report Attribute | Details |

| Estimated Market Value (2022) | USD 67.46 billion |

| Projected Market Value (2031) | USD 112.35 billion |

| Base Year | 2022 |

| Forecast Years | 2023 &ndash, 2031 |

| Scope of the Report | Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment- Based on By Product, End-use &, Region. |

| Segments Covered | By Product, End-use &, By Region. |

| Forecast Units | Value (USD Billion or Million), and Volume (Units) |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2023 to 2031. |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East &, Africa. |

| Countries Covered | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, and South Africa, among others. |

| Report Coverage | Market growth drivers, restraints, opportunities, Porter&rsquo,s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, market attractiveness analysis by segments and region, company market share analysis. |

| Delivery Format | Delivered as an attached PDF and Excel through email, according to the purchase option. |

Orthopedic Devices Dynamics

An important contributing factor is the ageing of the world',s population, as more and more people suffer from musculoskeletal conditions like osteoarthritis and fractures. Due to this change in demographics, there is a greater need for orthopaedic devices, especially joint implants and trauma fixation devices, as older people look for ways to live active lives and reduce pain from degenerative diseases.

Advancements in medical technology stand out as a pivotal force, fostering innovation across various segments of the orthopedic devices market. The development of next-generation materials, minimally invasive surgical techniques, and the integration of smart technologies into orthopedic devices contribute to improved patient outcomes, reduced recovery times, and enhanced overall efficacy. However, these innovations also present challenges, including stringent regulatory requirements and the need for substantial investments in research and development.

Orthopedic Devices Drivers

- Aging Population and Musculoskeletal Disorders

The growing global aging population is a significant driver for the orthopedic devices market. The ageing process makes people more vulnerable to musculoskeletal conditions like osteoarthritis and fractures, which raises the need for orthopaedic interventions. Demand for joint implants, in particular, is rising as seniors look for ways to manage age-related degenerative conditions and continue an active lifestyle. It is anticipated that this demographic trend will continue, offering a steady boost to market expansion.

- Technological Advancements and Innovation

Orthopaedic devices are a market driven by rapid innovation and technological advancements in medicine. The effectiveness of orthopaedic devices is being improved, patient outcomes are being improved, and recovery times are being shortened by the use of smart technologies, next-generation materials, and minimally invasive surgical techniques. Advancements like the use of robotics in orthopaedic surgeries and 3D printing for personalised implants are changing the game and drawing interest from patients and medical professionals. The advancement of technology not only caters to the changing requirements of patients but also creates new opportunities for market growth.

Restraints:

- Stringent Regulatory Requirements

Thorough regulatory requirements and approval procedures are a major barrier to the market for orthopaedic devices. Fulfilling the strict requirements set by regulatory bodies may result in longer development and commercialization timelines and higher costs. Complying with these guidelines is essential for guaranteeing patient safety and product effectiveness, however, it poses a difficulty for businesses seeking to introduce novel and inventive orthopaedic devices into the market.

- Cost Constraints and Limited Access to Healthcare

The high costs associated with orthopedic procedures and devices, coupled with limited access to advanced healthcare facilities in certain regions, act as restraints for market growth. Affordability becomes a critical factor, hindering the adoption of orthopedic interventions in some demographics. Addressing these cost constraints and improving accessibility to advanced orthopedic care are essential for broadening the market reach and ensuring equitable healthcare distribution.

Opportunities:

- Emerging Markets and Untapped Regions

The orthopedic devices market presents significant opportunities in emerging markets and untapped regions where there is a growing awareness of healthcare, rising disposable incomes, and an increasing prevalence of musculoskeletal disorders. Expanding into these markets allows companies to reach new patient populations and establish a foothold in regions with evolving healthcare infrastructure.

Segment Overview

- By Product

The product segmentation encompasses a comprehensive array of tools and devices essential for orthopedic interventions. Drill guides are precision instruments used to guide surgical drills during procedures, ensuring accuracy and optimal placement of implants. Guide tubes facilitate controlled insertion of various orthopedic devices, enhancing surgical precision. Implant holders secure implants in place during surgery, contributing to stability and precise placement. Custom clamps provide adaptability to different anatomies, allowing surgeons to tailor their approach based on patient-specific requirements.

Distractors aid in separating or distracting bone fragments, a critical step in certain orthopedic procedures. Screwdrivers are specialized tools for the precise insertion of screws, an integral component of many orthopedic implants. Accessories encompass a range of supplementary items, such as sterilization trays and covers, to support the efficient use of orthopedic devices.

- By End-use

The end-use segmentation reflects the varied settings where orthopedic procedures are conducted. Hospitals serve as the primary end-use segment, providing a comprehensive range of orthopedic services, from routine surgeries to complex interventions. The hospital setting is equipped with specialized orthopedic departments and surgical suites, facilitating a multidisciplinary approach to musculoskeletal care.

Outpatient facilities represent another critical end-use segment, catering to orthopedic procedures that do not require an extended hospital stay. These facilities include ambulatory surgery centres and outpatient clinics, offering convenience for patients and potentially reducing healthcare costs. The outpatient setting is particularly relevant for minor orthopedic procedures, diagnostics, and follow-up appointments, contributing to a more streamlined and accessible orthopedic care continuum.

Orthopedic Devices Overview by Region

North America commands a significant share, driven by a rapidly aging population, a high prevalence of orthopedic disorders, and well-established healthcare systems. The region',s emphasis on technological innovation further propels market growth, with the United States being a key contributor to advancements in orthopedic device technologies.

Europe follows closely, with robust healthcare infrastructure and a growing awareness of orthopedic interventions. The presence of a large aging population in countries like Germany and the United Kingdom contributes to sustained demand for joint replacement surgeries and other orthopedic procedures. Additionally, stringent regulatory standards in the European Union ensure a high level of product quality and safety, influencing market dynamics.

Asia-Pacific is showing signs of being a vibrant and quickly growing orthopaedic devices market. The market is expected to grow due to factors such as rising healthcare costs, growing middle-class populations in nations like China and India, and growing awareness of advanced treatment options. The region also witnesses a surge in sports-related injuries, further driving the demand for orthopedic interventions. However, challenges exist, including disparities in healthcare access and the need to navigate diverse regulatory landscapes.

Orthopedic Devices Market Competitive Landscape

Key players such as Johnson &, Johnson, Stryker Corporation, Medtronic, Zimmer Biomet Holdings, and Smith &, Nephew dominate the market, leveraging their extensive product portfolios, global distribution networks, and strong research and development capabilities. These companies focus on strategic initiatives, including mergers, acquisitions, and collaborations, to enhance their market position, broaden product offerings, and foster innovation.

The market also witnesses the emergence of smaller, innovative companies specializing in niche segments or cutting-edge technologies. Start-ups and technology-focused firms contribute to the dynamism of the market by introducing novel solutions, such as smart implants and minimally invasive surgical tools. The competitive landscape is further influenced by collaborations between established players and these innovators, facilitating the integration of new technologies into mainstream orthopedic practice.

Technological advancements play a pivotal role in shaping competition within the orthopedic devices market. Companies invest heavily in research and development to introduce products that offer improved patient outcomes, reduced recovery times, and enhanced overall efficiency. 3D printing, robotics, and smart technologies are among the areas witnessing substantial innovation, creating opportunities for differentiation among competitors.

Orthopedic Devices Recent Developments

- July 2023, Stryker has introduced the Ortho Q Guidance system, designed to provide advanced surgical planning and guidance for hip and knee procedures. Surgeons can easily control the system from the sterile field. The Ortho Q Guidance system utilizes new optical tracking options through an updated camera and sophisticated algorithms from the newly launched Ortho Guidance software. This combination offers enhanced surgical planning and guidance capabilities. When paired with the Ortho Q system, the Ortho Guidance software, applicable to Express Knee, Precision Knee, and Versatile Hip, functions as a planning and intraoperative guidance system. It improves procedural speed and efficiency, streamlining the workflow for a smarter surgical experience.

- Nov 2022, MicroPort Orthopedics, a prominent player in the global orthopedic devices and technologies sector, is pleased to reveal the broadening of its collaboration with Pixee Medical by launching their joint surgical solution in the United States. Leveraging Pixee Medical',s FDA-cleared augmented reality surgical application for support in total knee arthroplasty, surgeons can attain enhanced precision and control during the implantation of the MicroPort Evolution®, Medial-Pivot Knee Implant. This innovative solution has already demonstrated success in numerous cases globally, including Australia, Europe, and Asia.

Global Orthopedic Devices report segmentation

| ATTRIBUTE | , , , , ,DETAILS |

| By Product |

|

| By End-use |

|

| By Geography |

|

| Customization Scope |

|

| Pricing |

|

Report Details

- Published Date2024-12-22T15:59:46

- FormatPDF

- LanguageEnglish