Medical Membranes Market

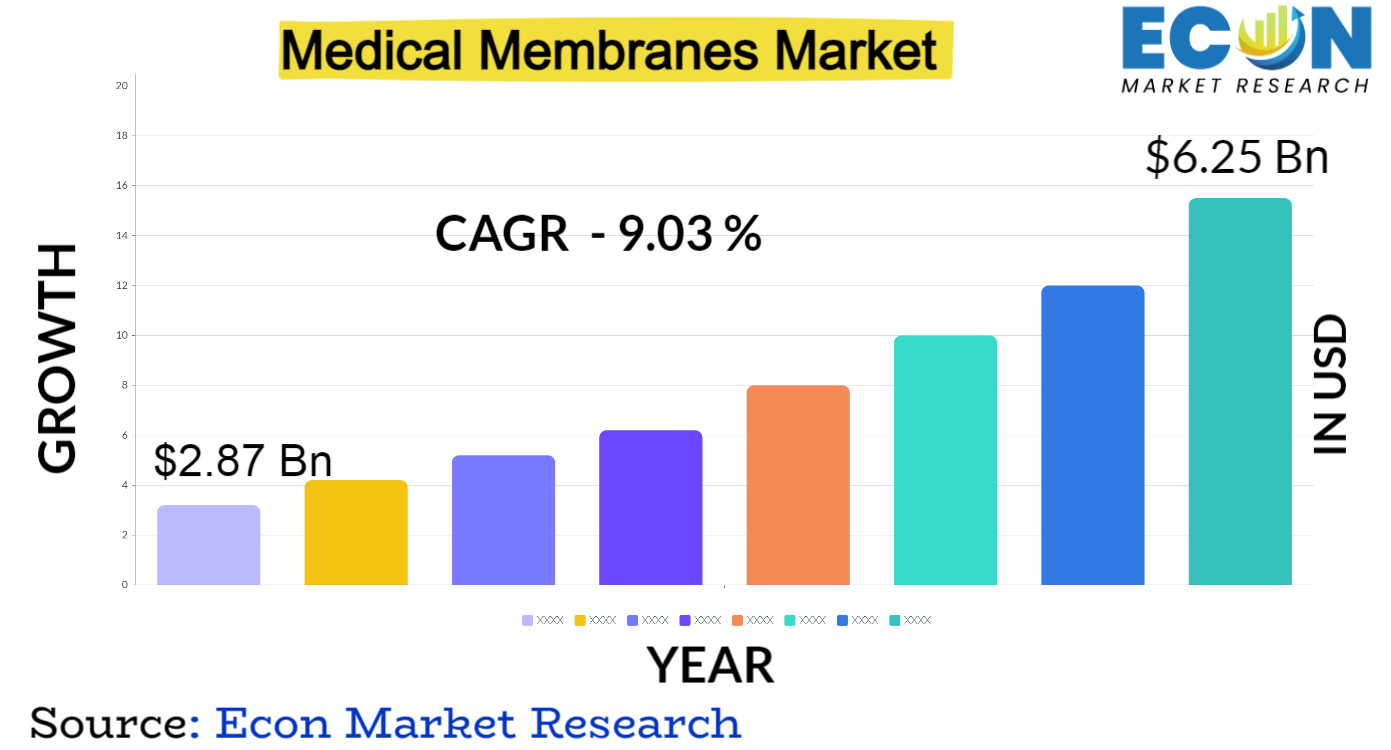

Global Medical Membranes Market is predicted to reach approximately USD 6.25 billion by 2032, at a CAGR of 9.03% from 2024 to 2032.

Medical membranes are semi-permeable, thin barriers with a wide range of uses in biotechnology, drugs, and medical devices. These membranes are essential to many processes, including drug delivery, separation, and filtration. Research and development efforts have been booming in the market, which has resulted in the creation of novel membrane technologies with improved biocompatibility and performance. Market growth is being driven by rising awareness of the advantages of medical membranes in tissue engineering, drug delivery systems, and diagnostic applications.

Medical Membranes Report Scope and Segmentation

| Report Attribute | Details |

| Estimated Market Value (2023) | USD 2.87 billion |

| Projected Market Value (2032) | USD 6.25 billion |

| Base Year | 2023 |

| Forecast Years | 2024 &ndash, 2032 |

| Scope of the Report | Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment- Based on By Technology, Chemical, Application, End Users, Distribution Channel &, Region. |

| Segments Covered | By Technology, Chemical, Application, End Users, Distribution Channel &, By Region. |

| Forecast Units | Value (USD Billion or Million), and Volume (Units) |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2024 to 2032. |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East &, Africa. |

| Countries Covered | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, and South Africa, among others. |

| Report Coverage | Market growth drivers, restraints, opportunities, Porter&rsquo,s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, market attractiveness analysis by segments and region, company market share analysis. |

| Delivery Format | Delivered as an attached PDF and Excel through email, according to the purchase option. |

Medical Membranes Dynamics

Research and development efforts in the market are increasing significantly, which is resulting in the release of innovative membrane technologies with improved performance attributes. Medical membranes are becoming more and more in demand as chronic diseases like diabetes and cardiovascular ailments become more common and call for more sophisticated treatment and diagnostic options. The significance of medical membranes in applications such as virus filtration has been further highlighted by the COVID-19 pandemic, leading to an increased emphasis on membrane-based technologies for infection control.

Strict regulations guaranteeing the effectiveness and safety of medical technologies and devices are a major factor influencing market dynamics. This regulatory framework promotes product development and innovation, creating a competitive environment where businesses aim to meet and surpass compliance standards. In order to take advantage of synergies in research capabilities and broaden their product portfolios, market players are investing more and more in strategic collaborations and partnerships.

Medical Membranes Drivers

- Increasing Chronic Diseases and Aging Population

The ageing of the global population and the rising prevalence of chronic diseases are major factors driving the medical membranes market globally. The increasing occurrence of ailments like diabetes, cardiovascular diseases, and kidney problems is driving up demand for cutting-edge medical solutions, including membrane-based technologies. Medical membranes are essential for a number of applications, including tissue engineering, drug delivery, and dialysis. They provide effective ways to treat and manage chronic illnesses. Because of this ongoing demand, the market is expanding, innovation is thriving, and R&,D spending is encouraged.

- Technological Advancements in Membrane Technologies

Constant improvements in membrane technologies are another important factor propelling the market. The goal of ongoing research and development is to improve medical membrane performance, selectivity, and biocompatibility. Advances in material science and manufacturing techniques are resulting in membranes with enhanced filtration performance, greater robustness, and a lower probability of unfavourable reactions. By enabling the development of more complex and efficient medical devices, these technological advancements not only meet the changing needs of medical applications but also help to expand the market.

Restraints:

- High Cost of Advanced Membrane Technologies

One major factor impeding market growth is the high cost of advanced membrane technologies. The adoption of these technologies is impeded by the significant upfront costs associated with research, development, and production, despite the fact that they provide superior performance and inventive solutions. The affordability and accessibility of medical membrane-based products are impacted by this cost issue, especially in areas with limited healthcare funding. To overcome this limitation and guarantee greater market acceptance and inclusivity, innovation and cost-effectiveness must be balanced.

- Stringent Regulatory Requirements

The market for medical membranes is constrained by strict compliance standards and regulatory requirements in the healthcare sector. Medical devices that use membrane technologies must pass a stringent approval process that includes extensive testing and documentation to guarantee quality, safety, and efficacy. Longer timeframes for product development and market entry may arise from this. The intricate regulatory environment necessitates large financial outlays and specialised knowledge, which could impede the rate of innovation and market penetration.

Opportunities:

- Rising Demand for Point-of-Care Diagnostics

The market for medical membranes has a bright future due to the rising demand for point-of-care diagnostics. Rapid diagnostic devices that allow for on-the-spot testing and analysis are developed largely thanks to membrane technologies. The need for membrane-based solutions in point-of-care diagnostics is anticipated to increase due to the growing emphasis on early disease detection and speedy results, opening up new opportunities for market players to investigate.

Segment Overview

- By Technology:

The technological segmentation includes nanofiltration, microfiltration, ultrafiltration, and reverse osmosis. Nanofiltration involves the use of membranes with fine pores, allowing for the separation of small particles and solutes. Microfiltration and ultrafiltration employ membranes with varying pore sizes to filter particles of different sizes, while reverse osmosis utilizes a semi-permeable membrane to remove impurities from water or other solutions. These technologies find applications across various medical processes, including drug delivery, hemodialysis, and sterile filtration.

- By Chemical Composition:

The chemical composition segment comprises materials used in membrane production, such as polyvinylidene fluoride, polytetrafluoroethylene, polyethylene, polysulfone, and modified acrylics. Each material offers specific characteristics, such as chemical resistance, durability, and biocompatibility, making them suitable for different medical applications. These chemical components play a crucial role in determining the performance and suitability of medical membranes for specific uses in healthcare settings.

- By Application:

Blood microfilters, drug delivery systems, hemodialysis membranes, intravenous infusion filters, sterile filtration, pharmaceutical filtration, protein purification, cell separation, and water filtration are just a few of the many uses for medical membranes in the healthcare sector. These varied uses demonstrate the adaptability of medical membranes in tackling a range of healthcare issues, from guaranteeing intravenous medication safety to enabling cutting-edge regenerative medicine therapies.

- By End-User:

End-users encompass ambulatory centers, clinics, community healthcare facilities, hospitals, and other healthcare settings. The varied end-user segments reflect the widespread adoption of medical membranes across different healthcare environments, catering to the specific needs and requirements of each setting. From point-of-care diagnostics in clinics to advanced surgical procedures in hospitals, medical membranes play a crucial role in enhancing healthcare outcomes.

- By Distribution Channel:

Distribution channels include direct tenders and retail. Direct tenders involve procurement through contractual agreements with manufacturers or suppliers, often in large quantities for healthcare facilities. Retail distribution encompasses the availability of medical membrane products through traditional retail channels, providing accessibility to smaller healthcare providers and end-users.

Medical Membranes Overview by Region

North America and Europe stand as dominant players in the market, propelled by well-established healthcare systems, high levels of research and development activities, and a proactive approach towards adopting advanced medical technologies. The presence of key market players and a robust regulatory framework further contribute to the growth of these regions.

The medical membranes market appears to have significant growth potential in the Asia-Pacific region. The demand for medical membrane technologies is driven by rising healthcare costs, population growth, and growing awareness of cutting-edge medical solutions. Innovation in membrane-based applications is being fostered by the region',s recent surge in research initiatives and collaborations. Additionally, the use of medical membranes for therapeutic, drug delivery, and diagnostic applications is growing due to the increased prevalence of chronic diseases in nations like China and India.

Medical Membranes Market Competitive Landscape

Prominent companies such as GE Healthcare, Pall Corporation (Danaher Corporation), Merck Group, 3M Company, and Asahi Kasei Corporation play pivotal roles in shaping the industry. These companies consistently invest in research and development to introduce novel membrane technologies, enhancing their product portfolios and maintaining a competitive edge.

In the market, strategic alliances and partnerships are common as businesses look to capitalise on complementary advantages. Collaborations and partnerships between membrane producers and end users, such as medical facilities and pharmaceutical firms, enable the creation of specialised solutions for particular medical uses. Furthermore, businesses looking to expand geographically, obtain access to new technologies, or solidify their market position frequently employ mergers and acquisitions as a strategy.

Medical Membranes Market Leading Companies:

-

3M Company

-

Asahi Kasei Medical Co. Ltd.

-

Pall Corporation

-

Merck Millipore

-

Sartorius AG

-

GE Healthcare Life Sciences

-

Koch Membrane Systems Inc.

-

W. L. Gore &, Associates, Inc.

-

Cantel Medical Corporation

-

Baxter Inte ational Inc.

-

Nipro Corporation

-

Amniox Medical, Inc.

Medical Membranes Recent Developments

- July 2023, DuPont has introduced its latest nanofiltration membrane elements, the DuPont FilmTec LiNE-XD series, designed for the commercial purification of lithium brine. These new offerings, LiNE-XD and LiNE-XD HP, mark DuPont',s initial venture into products specifically tailored for lithium brine purification. They excel in facilitating high lithium passage in chloride-rich Li-brine streams while demonstrating outstanding selectivity over divalent metals like magnesium.

- ,Dec 2023, Asahi Kasei has innovated a membrane system designed for dehydrating organic solvents in pharmaceutical applications, eliminating the need for heat or pressure. This development holds potential for streamlining manufacturing processes within the pharmaceutical industry. As part of practical validation, Asahi Kasei is now engaged in a collaboration with Ono Pharmaceutical to assess the effectiveness of this system.

- Dec 2023, NovaBay Pharmaceuticals, Inc. discloses its collaboration with Woo University aimed at assisting in the education of eyecare professionals regarding the utilization of amniotic membranes.

Global Medical Membranes Report Segmentation

| ATTRIBUTE | , , , , DETAILS |

| By Technology |

|

| By Chemical |

|

| By Application |

|

| By End-User |

|

| By Distribution Channel |

|

| By Geography |

|

| Customization Scope |

|

| Pricing |

|

,

No FAQs available.

Report Details

- Published Date2024-12-22T15:59:46

- FormatPDF

- LanguageEnglish