Industrial Barrier Systems Market

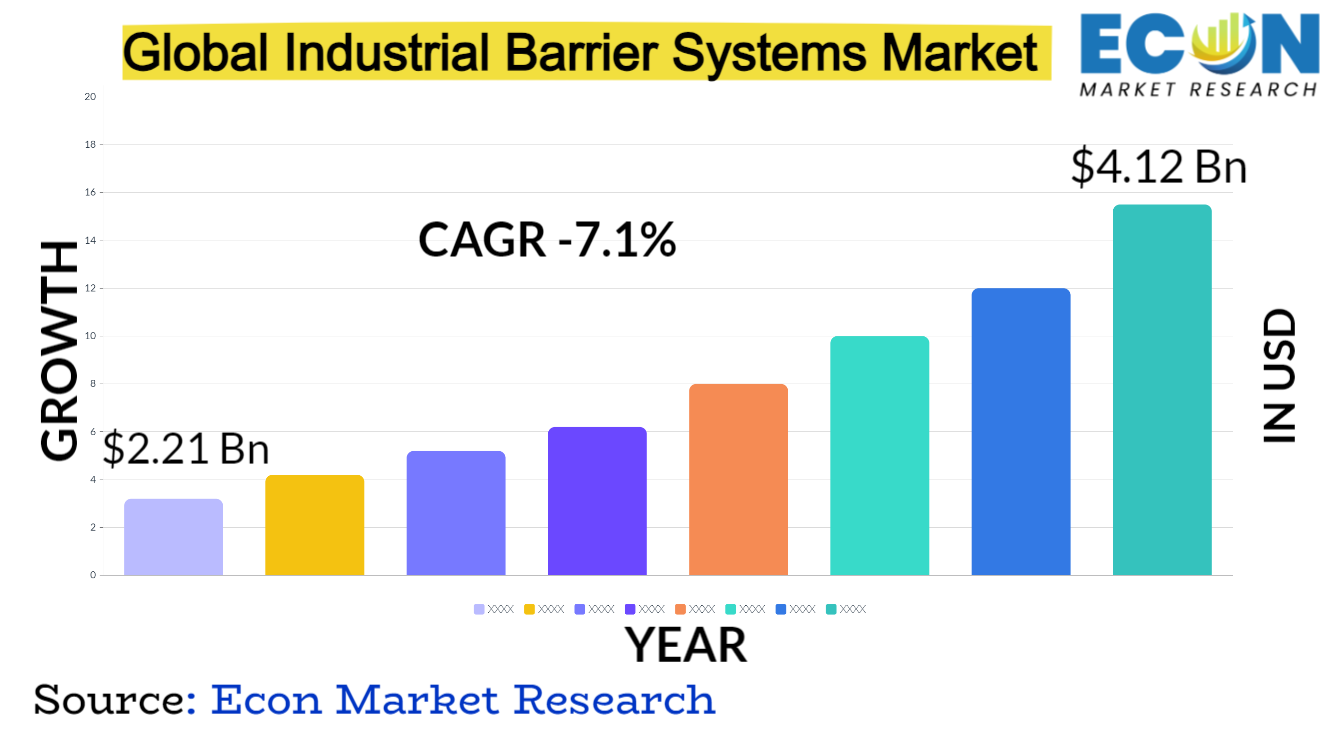

The Industrial Barrier Systems Market was valued at USD 2.21 billion in 2023 and is estimated to reach approximately USD 4.12 billion by 2032, at a CAGR of 7.1% from 2024 to 2032.

Over the years, the industrial barrier systems market has grown significantly and undergone innovation in response to the varied needs of numerous industries around the globe. These systems cover a broad range of physical security options, such as gates, bollards, fences, and barriers, and are intended to safeguard assets, infrastructure, and facilities against theft, vandalism, and illegal access.

Mode industrial barrier systems have evolved from their initial foundation of basic functionality to incorporate cutting-edge technologies such as sensors, automated controls, and AI-driven analytics, which improves their efficacy and flexibility. The market',s development has been propelled by growing security apprehensions, strict laws, and the ongoing progress of infrastructure in several industries, including transportation, energy, defense, and commerce.

Businesses in this industry are always working to provide barrier solutions that are strong, adaptable, and visually beautiful, that can blend in well with the current infrastructure and provide excellent protection and operational efficiency. The creation of barriers powered by renewable energy sources and composed of recyclable materials has also been prompted by the growing emphasis on environmentally friendly and sustainable solutions. The market for industrial barrier systems is expected to increase steadily over the next several years as technology advancements and safety and security measures become more and more important to various sectors.

| Report Attribute | Details |

| Estimated Market Value (2023) | 2.21 Bn |

| Projected Market Value (2032) | 4.12 Bn |

| Base Year | 2023 |

| Forecast Years | 2024 - 2032 |

| Scope of the Report | Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment- By Type, By Function, By Access Control Device, By Material, &, Region |

| Segments Covered | By Type, By Function, By Access Control Device, By Material, &, Region |

| Forecast Units | Value (USD Billion or Million), and Volume (Units) |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2024 to 2032 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East &, Africa, and the Rest of World |

| Countries Covered | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, and South Africa, among others |

| Report Coverage | Market growth drivers, restraints, opportunities, Porter&rsquo,s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, market attractiveness analysis by segments and region, company market share analysis, and COVID-19 impact analysis. |

| Delivery Format | Delivered as an attached PDF and Excel through email, according to the purchase option. |

Industrial Barrier Systems Market Dynamics

The main forces behind this are growing security conce s and the demand for improved safety measures in a variety of industries, including transportation, vital infrastructure, and commercial places. The need for strong, cutting-edge barrier systems is fueled by these worries, as well as an increase in car accidents and security risks. Gove ment regulations and industry associations', strict safety requirements have a big impact on this sector as well.

The construction of dependable and certified barrier systems is frequently required by compliance standards, which forces industries to invest in mode solutions. Furthermore, technology breakthroughs are a major factor in how the industry is shaped. Smart barriers, which possess automated controls, sensors, and connectivity characteristics, are becoming more and more popular because of their capacity to offer adaptive security measures and real-time monitoring.

Environmental factors also impact market dynamics, which leads to the creation of barrier solutions that are eco-friendly by utilizing sustainable materials and renewable energy sources. The competitive dynamics among market participants, who are vying to provide solutions that are efficient, affordable, and adaptable, also support the market',s upward trajectory. In general, the dynamic landscape of the industrial barrier systems market is shaped by the interaction of security requirements, legal frameworks, technical advancements, environmental conce s, and industry competitive tactics.

Industrial Barrier Systems Market Drivers

- Rising Security Conce s

Increased risks of theft, vandalism, terrorism, and illegal access in a number of industries have highlighted the vital need for strengthened security infrastructure. Advanced barrier system demand has directly increased as a result of growing conce s about asset protection and safety. Businesses are realizing more and more how important barriers are to reducing security threats and protecting important resources like people, buildings, and assets.

The need for extensive security measures has been heightened by incidents of vehicular attacks and unlawful entrance, leading to the installation of high-security barriers that serve as a deterrence against these dangers. Furthermore, new security conce s now include digital vulnerabilities in addition to physical breaches. Because of this, there is an increasing focus on comprehensive security solutions, which combine technical defenses with physical barrier systems to provide strong, multi-layered protection.

Rising security conce s are not unique to any one industry, they are a result of factors that are present in a variety of sectors, including public spaces, transportation, energy, defense, and commerce. As a result, innovative and adaptable barrier systems that can effectively address a wide range of dynamic security challenges are becoming more and more important in the marketplace.

- Urbanization and Population Growth

The market for industrial barrier systems is influenced by factors such as population growth and urbanization, which have an effect on infrastructure expansion, heightened security requirements, and the need for improved safety measures in crowded locations. The global trends of rapid urbanization, coupled with an increase in population living in urban areas, are driving major infrastructure development in cities and metropolitan areas.

The necessity to efficiently manage and secure the expanding infrastructure arises as metropolitan areas grow. This covers public areas, residential complexes, vital facilities, and transit networks all of which call for extensive security measures. The growing population in cities increases the demand for traffic management, crowd control, and security against possible dangers like intentional attacks or auto accidents. Furthermore, because metropolitan areas are dense, they frequently have increased risks of security lapses and incidents. This fact fuels the need for dependable and flexible barrier systems that can handle a range of security issues in metropolitan settings.

Restraints:

- High Initial Investment for Advanced Barrier Systems

These complex systems, which include state-of-the-art components like automation, sensors, and integrated security measures, can be expensive up front. This cost barrier may prevent prospective customers from using these cutting-edge solutions, particularly smaller companies or those with tighter budgets. The barrier systems itself as well as installation costs are included in the original investment, which might increase the overall cost. Furthermore, the price does not end with installation, continuing upkeep, repairs, and future additions add to the total cost.

Because of its high cost, adoption and accessibility rates are restricted, especially in industries where funding security measures takes precedence over other operational conce s. Because of financial limitations, some businesses may choose to use antiquated or less sophisticated barrier systems, sacrificing the degree of security and technological complexity they may otherwise enjoy.

- Complex Installation and Integration

It can be difficult to implement these systems and frequently entails complex technological requirements, particularly when combining them with current infrastructure or security configurations. The installation process becomes more complex when barrier systems have to be matched to different architectural styles, different topographies, or different operating environments. Mode barrier systems are equipped with sophisticated technology, which presents additional integration challenges. It frequently takes specialist knowledge and careful planning to ensure flawless communication, interoperability with other security components, and compatibility with current systems.

Organizations may be discouraged from pursuing upgrades or new installations if complex installation procedures lead to extended downtime or interfere with ongoing operations. Another limitation is the lack of qualified experts who can install and configure these sophisticated systems. It causes implementation delays and possible inefficiencies during the integration stage, which eventually affects the barrier system',s overall effectiveness. Simplified installation procedures, standardized integration interfaces, and more training opportunities are required to help the workforce become more proficient in managing these complicated installations in a more timely and effective manner.

Opportunities:

- Technological Advancements

The development of more intelligent, adaptable, and responsive solutions is made possible by the integration of cutting-edge technologies like automation, inte et of things (IoT), and artificial intelligence (AI) into barrier systems. Real-time monitoring, data-driven insights, and adaptive functions that can react in advance to security threats or shifting environmental circumstances are made possible by these innovations. Furthermore, advancements in technology provide doors to better user experiences and increased operational effectiveness. Sensor-equipped smart barriers can optimize maintenance and minimize downtime by sending out predictive maintenance alerts.

Sophisticated automation makes it possible to monitor and control security protocols remotely, providing flexibility and ease. Moreover, these systems can lea and adapt thanks to AI-driven analytics, which improves their capacity to recognize possible threats and take preventative action. Innovation in building materials and techniques is encouraged by technological advancements, which results in the creation of barrier solutions that are more long-lasting, sustainable, and reasonably priced. In order to create safer and more robust infrastructures, there are opportunities to strengthen security measures as well as to create seamless, interconnected systems that meet the changing needs of various businesses.

- Customization and Adaptability

In the industrial barrier systems market, customization and adaptability offer strong prospects since they provide precisely the right solutions to meet the particular requirements and specifications of different infrastructures and sectors. Customizing barrier systems enables the development of modular, scalable, and flexible solutions that may be used to solve particular security issues or blend in with a variety of settings. Barriers that address specific spatial limits, security hazards, or operational requirements are frequently needed by many industries.

Customization makes it easier to create barriers with different functions, sizes, and shapes so they blend in well with the current infrastructure without sacrificing efficiency. A customized security solution is made possible by this customized approach, which goes beyond physical characteristics to include technical features, access restrictions, and integration possibilities. Adaptability is equally important since it allows barriers to change in tandem with evolving technology and security requirements. Long-term security plans can be sustained with dynamic systems that are quickly upgraded or modified to meet new operational demands or threats. Meeting present needs is just one aspect of the opportunity, another is offering adaptable solutions that may develop and change with the industries they service.

Segment Overview

- By Type

Based on type, the global industrial barrier systems market is divided into bollards, safety fences, safety gates, guardrails, barriers for machinery, others. The barriers for machinery category dominates the market with the largest revenue share in 2023. These barriers are specifically designed to safeguard machinery, equipment, or hazardous areas within industrial facilities. They prevent unauthorized access, mitigate risks associated with moving parts, and ensure worker safety. Bollards are sturdy, short vertical posts typically installed to create protective perimeters or restrict vehicle access in specific areas. They come in various designs and materials, serving as effective barriers against vehicle impacts, especially in high-traffic areas or around critical infrastructure.

Safety fences are physical barriers constructed using materials like wire mesh, steel, or other durable components. They',re utilized to create boundaries, secure perimeters, or prevent unauthorized access to hazardous zones within industrial sites or construction areas. Safety gates are gate systems integrated into safety fencing or standalone structures, providing controlled access points. These gates often incorporate safety features such as locking mechanisms, access control systems, and sensors to manage entry and exit while maintaining security.

- By Function

Based on the function, the global industrial barrier systems market is categorized into active barriers, passive barriers. The passive barriers category leads the global industrial barrier systems market with the largest revenue share in 2023. Passive barriers are static or fixed barrier systems that do not possess active mechanisms or responsive features. These barriers primarily serve as physical deterrents or protective structures without inherent dynamic functionalities. Active barriers refer to barrier systems that possess dynamic, responsive, or automated functionalities. These barriers are equipped with active mechanisms or technologies that actively engage or respond to exte al stimuli such as threats, movements, or specific triggers.

- By Access Control Device

Based on access control device, the global industrial barrier systems market is segmented into biometric systems, perimeter security systems &, alarms, token &, reader function, tu stile, others. The token &, reader function segment dominates the industrial barrier systems market. This category includes access control systems that rely on tokens (such as keycards, RFID tags, or smart cards) and corresponding readers for access authorization. Users present their tokens to readers equipped with authentication capabilities to gain access through barriers or gates, ensuring controlled entry into secured areas.

Tu stiles are mechanical or electronic barriers that regulate pedestrian traffic by allowing one person at a time to pass through. These can incorporate token-based access control, biometric authentication, or ticket scanning systems, effectively controlling the flow of individuals into or out of restricted areas within industrial premises. Biometric systems in industrial barrier solutions utilize unique biological characteristics such as fingerprints, iris scans, facial recognition, or palm prints to control access or authorize entry into secured areas. These systems offer high-security authentication and are often employed in critical infrastructure facilities, data centers, or restricted zones within industries where stringent access control is paramount.

Perimeter security systems form a crucial part of industrial barrier solutions, encompassing technologies like motion sensors, surveillance cameras, laser detectors, and intrusion detection systems. These systems monitor and secure the perimeter of industrial sites, providing early detection and alerts for unauthorized access or potential security breaches.

- By Material

Based on material, the global industrial barrier systems market is divided into metal, non-metal. The metal category dominates the market with the largest revenue share in 2023. Barriers categorized as metal are primarily constructed using various types of metals such as steel, iron, aluminum, or alloys. Metal barriers offer robustness, durability, and strength, making them suitable for high-security applications and areas requiring heavy-duty protection. They are often utilized in scenarios where resilience against impact, force, or deliberate attacks is crucial. Non-metal barriers encompass a range of materials other than metal, including plastics, composites, concrete, wood, or recycled materials. These barriers offer diverse characteristics and are often chosen based on specific requirements such as aesthetics, corrosion resistance, or environmental considerations.

Industrial Barrier Systems Market Overview by Region

The global industrial barrier systems market is categorized into North America, Europe, Asia-Pacific, and the Rest of the World. North America emerged as the leading region, capturing the largest market share in 2023. The area has a thriving industrial environment that includes a variety of industries like energy, transportation, manufacturing, and vital infrastructure.

The need for industrial barrier systems has been greatly boosted by the necessity for strict safety regulations and cutting-edge security solutions within these industries. Furthermore, North America places a high priority on mode izing and developing its infrastructure, which has resulted in large expenditures to improve security and safety in a variety of industrial sites. Proactive measures combined with strict legal frameworks that prioritize safety have sped up the implementation of cutting-edge barrier systems.

Furthermore, the region',s innovation hubs and technical breakthroughs propel the creation of state-of-the-art barrier technologies such advanced sensor-based solutions, integrated access control systems, and smart barriers. These developments support market expansion by addressing the changing security requirements of various industries. Additionally, North America',s increased security conce s especially in light of the necessity for perimeter protection and the rise in security threats have fueled demand for high-security barrier solutions and greatly aided in the company',s market leadership.

Industrial Barrier Systems Market Competitive Landscape

In the global industrial barrier systems market, a few major players exert significant market dominance and have established a strong regional presence. These leading companies remain committed to continuous research and development endeavors and actively engage in strategic growth initiatives, including product development, launches, joint ventures, and partnerships. By pursuing these strategies, these companies aim to strengthen their market position, expand their customer base, and capture a substantial share of the market.

Some of the prominent players in the global industrial barrier systems market include A-Safe, BOPLAN, Ritehite, Fabenco by Tractel, Lindsay Corporation, Valmont Industries Inc., Barrier1, Betafence, Gramm Barriers, Hill &, Smith PLC, CAI Safety Systems, Inc., Kirchdorfer Industries, Tata Steel, Arbus, and Avon Barrier Corporation Ltd, and various other key players.

Industrial Barrier Systems Market Recent Developments

- In June 2023, Ritehite unveiled RiteLoad, a next-generation dock leveller featuring improved design, reinforced structure, and cutting-edge regulating systems that put safety first. Ten years of construction and steelwork warranty are made possible by the optimized plateau construction and telescopic lip guidance, which offer stability and longevity.

Industrial Barrier Systems Market Report Segmentation

| ATTRIBUTE | , , , , DETAILS |

| By Type |

|

| By Function |

|

| By Access Control Device |

|

| By Material |

|

| By Geography |

|

| Customization Scope |

|

| Pricing |

|

,

Report Details

- Published Date2024-12-22T15:59:46

- FormatPDF

- LanguageEnglish