Flow Computer Market

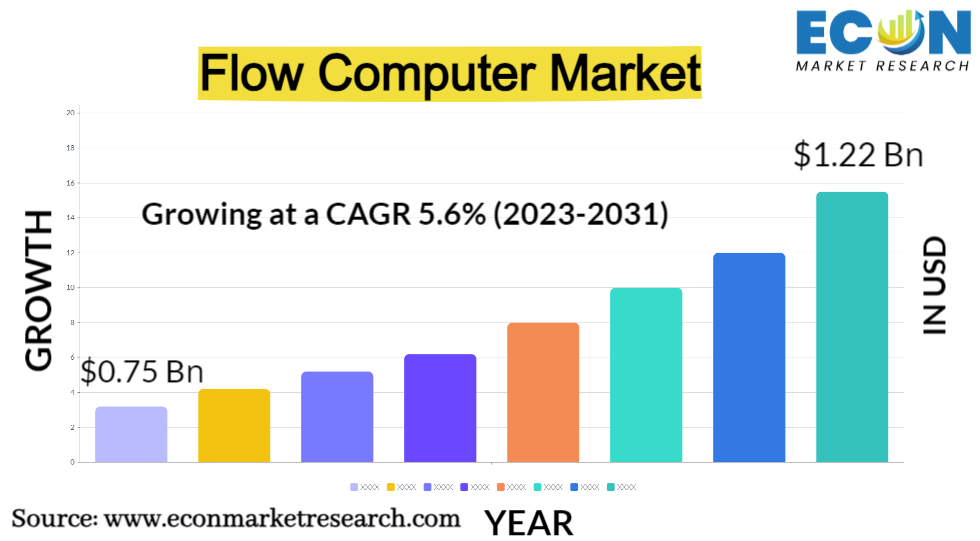

The Flow Computer Market was valued at USD 0.75 billion in 2022, and is predicted to reach approximately USD 1.22 billion by 2031, at a CAGR of 5.6% from 2023 to 2031.

A flow computer is a specialized electronic device designed for the measurement, calculation, and regulation of liquid or gas flow in various industrial processes. It finds extensive usage in industries such as oil and gas, petrochemicals, water treatment, and manufacturing. Flow computers gather data from multiple sensors and instruments, including flow meters, pressure sensors, temperature probes, and density meters, to accurately determine parameters like flow rate, volume, and other relevant factors. They perform intricate calculations, such as linearization, compensating for temperature and pressure fluctuations, and converting flow rates. These devices often come equipped with communication capabilities to transmit data to supervisory control and data acquisition (SCADA) systems or other control systems.

,

FLOW COMPUTER MARKET: REPORT SCOPE &, SEGMENTATION

| Report Attribute | Details |

| Estimated Market Value (2022) | 0.75 Bn |

| Projected Market Value (2031) | 1.22 Bn |

| Base Year | 2022 |

| Forecast Years | 2023 - 2031 |

| Scope of the Report | Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment- By Component, By Connectivity, By Application, &, Region |

| Segments Covered | By Component, By Connectivity, By Application, &, Region |

| Forecast Units | Value (USD Billion or Million), and Volume (Units) |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2023 to 2031 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East &, Africa, and Rest of World |

| Countries Covered | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, and South Africa, among others |

| Report Coverage | Market growth drivers, restraints, opportunities, Porter&rsquo,s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, market attractiveness analysis by segments and region, company market share analysis, and COVID-19 impact analysis. |

| Delivery Format | Delivered as an attached PDF and Excel through email, according to the purchase option. |

Flow Computer Market Dynamics

The surge in demand for precise flow measurement and control across diverse industries, including oil and gas, chemical, and water management, is a significant driving force. Industries are increasingly prioritizing process optimization, operational efficiency, and regulatory compliance, creating a need for dependable flow measurement solutions.

The rising adoption of automation and digitalization in industrial processes is further fueling the demand for advanced flow computing devices that seamlessly integrate with mode control systems and facilitate smooth data transmission. Additionally, the requirement for enhanced operational safety, improved product quality, and accurate billing and custody transfer solutions adds to the growth of the flow computer market. Furthermore, the expanding exploration and production activities in the oil and gas sector, coupled with increased investments in infrastructure development projects, are also contributing to the growing demand for flow computers.

Flow Computer Market Drivers

- Increasing Demand for Accurate Flow Measurement and Control

Various industries, such as oil and gas, chemical, and water management, are experiencing a growing need for precise flow measurement and control. Industries are focused on optimizing processes, ensuring operational efficiency, and complying with regulatory requirements, which drives the demand for reliable flow measurement solutions.

Restraints:

- Lack of Skilled Workforce

The initial investment required for implementing flow computing solutions can be substantial, especially for small and medium-sized enterprises. This cost can act as a restraint for organizations looking to adopt flow computers, particularly in budget-constrained environments.

Opportunities:

- Advancements in Industrial IoT and Connectivity

The advancements in the Industrial Inte et of Things (IoT) and connectivity technologies present opportunities for flow computer market expansion. Integration with IoT platforms and cloud-based systems can enhance the functionality and capabilities of flow computers, opening up new possibilities for data analysis and process optimization.

Segment Overview

- By Component Type

Based on the component type, the global flow computer market is segmented into hardware and software. The hardware segment is dominating the market with the largest revenue share of around 44.5% in 2022. Several factors contribute to this phenomenon. The bedrock of flow computing systems lies in their hardware components, encompassing flow meters, pressure sensors, temperature probes, and density meters. These tangible devices play a vital role in achieving precise and dependable flow measurement and control. Hardware solutions are renowned for their resilience, durability, and exceptional performance, making them well-suited for challenging industrial environments. Industries, including oil and gas, chemical, and water management, heavily depend on rugged and trustworthy hardware components to guarantee accurate flow measurement and sustained operation.

- By Connectivity Type

Based on the connectivity type, the global flow computer market is segmented into wired and wireless. The wireless segment is dominating the market with the largest revenue share of around 72.6% in 2022. Wireless technologies provide a multitude of benefits in comparison to wired solutions, including flexibility, ease of installation, and cost-effectiveness. When using wireless flow computers, data can be transmitted instantly without the requirement of extensive cabling infrastructure. This enables simpler deployment and reduces installation costs, especially in remote or challenging-to-access locations.

Wireless solutions offer enhanced mobility, allowing for effortless repositioning of flow meters or sensors without the limitations imposed by physical wiring. This flexibility is particularly advantageous in industries with dynamic or evolving process requirements. Furthermore, wireless technologies deliver improved scalability, facilitating the easier expansion or modification of flow measurement systems according to operational needs.

- By Application

Based on application, the global flow computer market is segmented into oil &, gas, water &, wastewater, energy &, power generation, food &, beverage, chemical, pulp &, paper, metal &, mining, and others. The oil &, gas segment is anticipated to grow at a higher CAGR of 6.5% during the forecast period. The worldwide demand for oil and gas is continuously increasing, resulting in heightened exploration, production, and transportation activities. To optimize processes, monitor production, and facilitate efficient custody transfer, accurate flow measurement and control are imperative for these operations.

The growing complexity of oil and gas activities, encompassing offshore drilling, unconventional resources, and intricate pipeline networks, underscores the need for advanced flow computing solutions. These solutions enable precise measurement of flow rates, volumes, and parameters at different stages of the production and distribution process. Furthermore, stringent regulatory requirements and safety standards within the oil and gas industry act as additional drivers for the adoption of reliable flow computers.

Flow Computer Market Overview by Region

By Region, the global flow computer market has been divided into North America, Europe, Asia-Pacific, and the Rest of the World. North America held the largest share, of around 42.6%, of the global market in 2022. The region hosts prominent sectors including oil and gas, chemical, and water management, which extensively employ flow measurement and control systems. Additionally, the increasing investments in infrastructure development and the presence of major flow computer manufacturers further strengthen North America',s dominance in the flow computer market. These industries have a demand for precise and dependable flow computing solutions to optimize their operations, ensure efficiency, and adhere to stringent regulations.

North America is renowned for its advanced technological infrastructure and high-level industrial automation, which facilitates the adoption of sophisticated flow computer technologies. Furthermore, the region benefits from a skilled workforce and well-established research and development facilities, fostering innovation and the advancement of flow computing solutions.

,

,

Flow Computer Market Competitive Landscape

The global flow computer market is characterized by a limited number of prominent players who possess significant market dominance and have successfully established a strong regional presence. These key participants demonstrate a steadfast commitment to ongoing research and development initiatives. Moreover, they actively pursue strategic growth endeavors, such as product development, launches, collaborations, and partnerships. Through the implementation of these strategies, these companies aim to fortify their market position and expand their customer base, effectively capturing a considerable share of the market.

Some of the notable players in the global flow computer market are ABB Ltd., Cameron Inte ational, Emerson, Rockwell Automation, Yokogawa Electric Corporation, Honeywell Inte ational, Thermo Fischer Scientific, Dynamic Flow Computers, Kessler-Ellis Products, Schneider Electric, and various other key industry players.

Flow Computer Market Recent Developments

- In June 2022, ABB and Wison Offshore &, Marine Limited (WOM), a provider of clean energy technology and solutions, have formed a strategic alliance to collaboratively create and implement floating liquefied natural gas (FLNG) facilities on a global scale.

Flow Computer Market Report Segmentation

| ATTRIBUTE | DETAILS |

| By Component |

, |

| By Connectivity |

, |

| By Application |

, |

| By Geography |

|

| Customization Scope |

|

| Pricing |

|

No FAQs available.

Report Details

- Published Date2024-12-22T15:59:46

- FormatPDF

- LanguageEnglish