Digital Agriculture Market

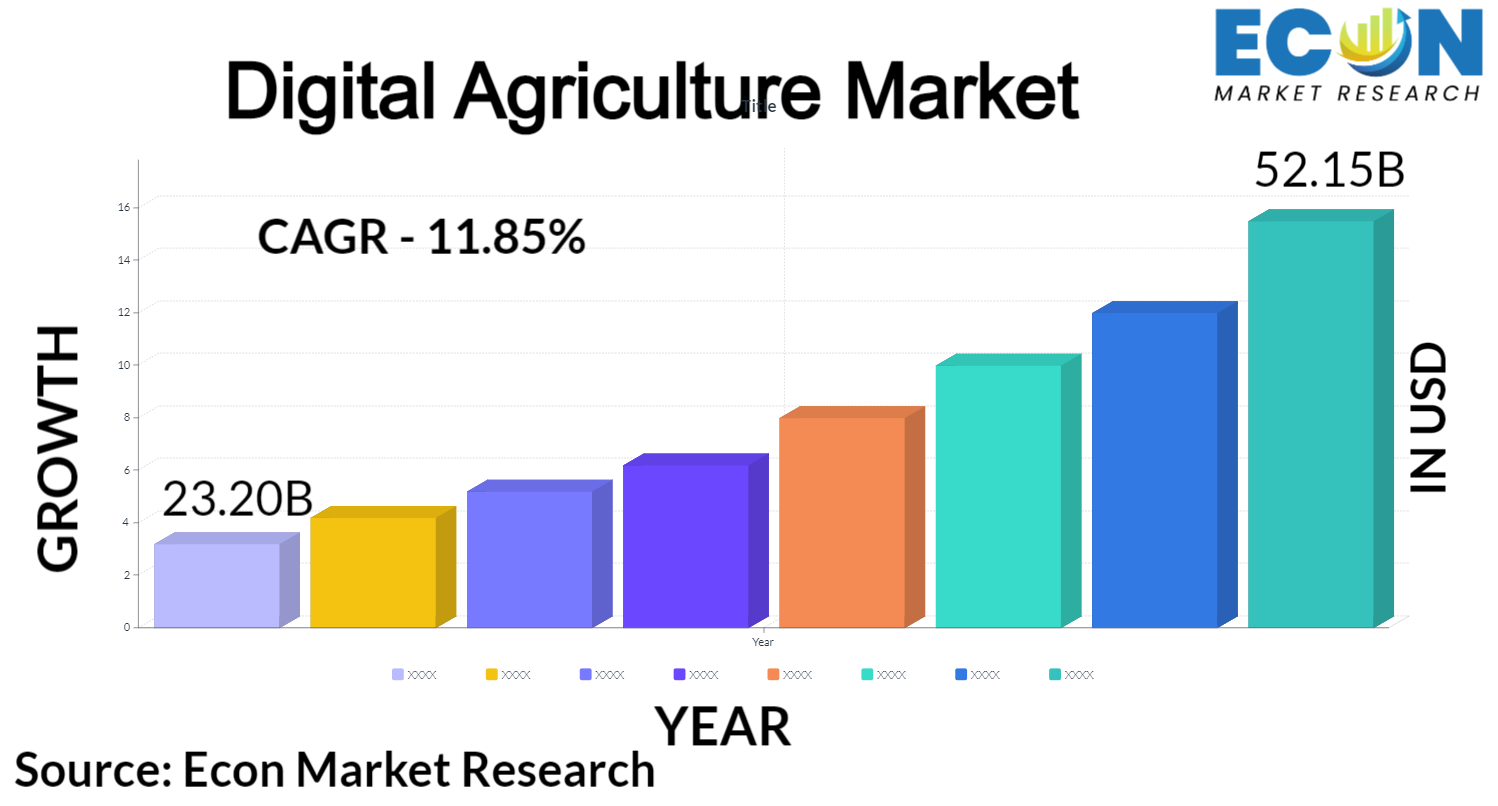

Global Digital Agriculture Market size was USD 23.20 billion in 2022 and is predicted to reach USD 52.15 billion in 2031, exhibiting at a CAGR of 11.85% ,during the forecast period.

Farmers are under increasing pressure to use fewer pesticides to produce more food and animal feed. It is getting harder to feed the growing population because of the rising population. Agriculture production is under more stress than before. The usage of precision farming software and Inte et of Things solutions will benefit the agriculture industry. Digital agricultural instruments that employ sensors to track the growth of the crops and keep tabs on the temperature and soil quality in the fields are becoming more and more common. These tools let farmers examine the climate for the growth of different crops. Post-pandemic, farming is using inte et channels much like all the other industries. Digital agriculture is seeing a surge in investments and technologies. The lives of diverse farmers around the world are getting better thanks to an increasing reliance on technology.

Market Growth

The expansion of the agriculture market can be attributed to a greater understanding of the advantages of digital agriculture in improving the optimization of agricultural production. Numerous farmers have started using these digital agricultural instruments as a result of the rising demand for food caused by the growing population. Strategic policymaking helps to encourage farmers to use these new technologies in many nations. The adoption of these new, cutting-edge technology by farmers is supported by a variety of agricultural consulting services, allowing them to use resources cost-effectively and effectively while also overcoming hurdles. Farmers can increase their yield and reduce losses by using these software programs.

Market Drivers

There has been a significant rise in the agriculture business as a result of growing knowledge about how digital agriculture may optimize agricultural production. Farmers will inevitably adopt digital agriculture equipment to keep up with the rising food demand brought on by the expanding world population. Farmers should be encouraged to use the relevant technology through strategic policy decisions made by the nations about precision farming. Science and practice are being bridged via farm advisory services. One of the main forces propelling the digital agriculture market is the technological developments and improvements, which assist farmers to optimize productivity and reducing losses through resource-efficient resource utilization.

Market Restraints

The lack of technological expertise among people is another factor that is anticipated to restrain the growth of the digital agriculture market over the forecast period. The quick standardization process, however, may present further difficulties for the development of the digital agriculture sector in the near future.

This report on the global digital agriculture market details recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, and geographical information

Market Opportunities

Through improved yields and the avoidance or reduction of food loss, artificial intelligence and the Inte et of Things have the potential to revolutionize agriculture. For example, the world population increased to 7.87 billion in 2021 from 7.76 billion in 2020, according to ",The World Bank,", a US-based inte ational financial institution that offers loans and grants to the gove ments of low- and middle-income nations. The market for digital agriculture is therefore being driven by the growing population. A crucial trend gaining popularity in the digital agriculture market is the penetration of technology and electronic devices. To maintain their market share, major companies involved in digital agriculture are concentrating on the uptake of technology and electronic devices.

| Report Attribute | Details |

| Projected CAGR in % | 11.85% |

| Estimated Market Value (2022) | 23.20 Billion |

| Base Year | 2022 |

| Forecast Years | 2023 - 2031 |

| Segments Covered | By Business Channel, By Product Type, By Component Type, By Deployment, By Type, By Company Type |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2023 to 2031 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East &, Africa, and Rest of World |

| Countries Covered | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, and South Africa, among others |

| Report Coverage | Market growth drivers, restraints, opportunities, Porter&rsquo,s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, market attractiveness analysis by segments and region, company market share analysis, and COVID-19 impact analysis. |

Covid-19 Impact on the Digital Agriculture Market

Digital agriculture has suffered significantly as a result of the recent coronavirus outbreak. The COVID-19 pandemic produced supply chain delays, lockdowns, and a shortage of equipment, which led to a minor fall in the digital agricultural market in 2020. However, during the post-COVID-19 period, greater adoption may result through the usage of remote sensing and farm management software applications. The digital agriculture supply chain has been disrupted by COVID-19, and businesses are testing out novel technological approaches to interact with producers and farmers.

Competitive Landscape

Some of the major players operating in the digital agriculture market are:

- DTN (US),

- Farmers Edge Inc. (Canada),

- Taranis (US),

- Eurofins Scientific (Luxembourg),

- AgriWebb (Australia),

- Monsanto Company (US),

- Bayer AG (Germany),

- Deere &, Company. (US),

- Accenture (Ireland),

- Syngenta AG (Switzerland),

- AgGateway (US),

- CropX inc. (US),

- Farmers Business Network (US),

- BASF SE (Germany),

- DigitalGlobe (US)

Regional Analysis

During the time of forecasting, the Asia-Pacific region is anticipated to lead the global digital agricultural market. Regarding the use of smart farming techniques, the Chinese agriculture sector has undergone a major change. The market is anticipated to expand as a result of the use of sensor-based technologies such as gear tooth sensor-based irrigation and fertilizer equipment. Mechanization has accelerated, and farmers are embracing innovative agricultural techniques. India',s progress toward agricultural mode ization and vitalization is greatly aided by digital technology. The growth of technologically advanced agricultural equipment, which is readily available throughout the Asia Pacific area, as well as an increase in gove ment support for the formation of these tech enterprises, are what is driving the market for digital agriculture in this region.

Report Segmentations

- Product Type Insight

The perishable segment is anticipated to rule the market over the forecast period based on product type. Perishable items in the online agriculture market include dairy goods, fresh fruits and vegetables, meat, fish, and poultry.

- Business Channel Insight

In the market for digital agriculture, it is anticipated that the B2B segment will hold the largest market share. Instead of the end user and the company, B2B commerce takes place between businesses. The farmers are given access to a wide range of resources, including software tools, data analysis, and value-added services for logistics. These B2B services help farmers increase the productivity and cultivation of their crops.

Recent Development

- In 2021, the CSIRO will grant Melbou e-based digital agricultural services license rights to utilize their grain cast crop forecasting tool. Grain cast is used to identify and forecast risks including drought, flood, and fire as well as a region',s productivity.

- In the year 2021, CNH Industrial introduced AGXTEND in Brazil. It is a cutting-edge platform for electronic agricultural products. Offering the greatest standards for all phases of the crop cycle is the solution, which will be incredibly advantageous for all different types and profiles of farmers. The management and monitoring solutions rely on the drone',s captured photographs. Additionally, it provides soil monitoring.

- According to a Chinese gove ment announcement, a digital town would be tested in 2020. According to the China Inte et Network Information Center, China assisted the largest population in the world. This demographic used the Inte et and services associated with the online world. Digital services are being used by many farmers in China for agricultural purposes, which is assisting them financially. In China',s rural villages, there is an increase in per capita income.

- A new business unit that will be able to provide innovative and cutting-edge solutions for the agricultural industry has been formed by TELUS Agriculture, one of the top players in the farm industry. The service will be useful for data analysis and the more effective and efficient manufacturing of food.

Segmentations

By Business Channel

- B2B

- B2C

By Product Type

- Perishables

- Non-perishables

- Raw materials

- Others

By Component Type

- Hardware

- Software

- Devices

By Deployment

- Cloud

- On-Premise

- Hybrid ,

By Type

- Crop Monitoring

- Artificial Intelligence

- Precision Farming

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East &, Africa (MEA)

Report Details

- Published Date2024-12-22T15:59:46

- FormatPDF

- LanguageEnglish