Battery Electrolytes Market

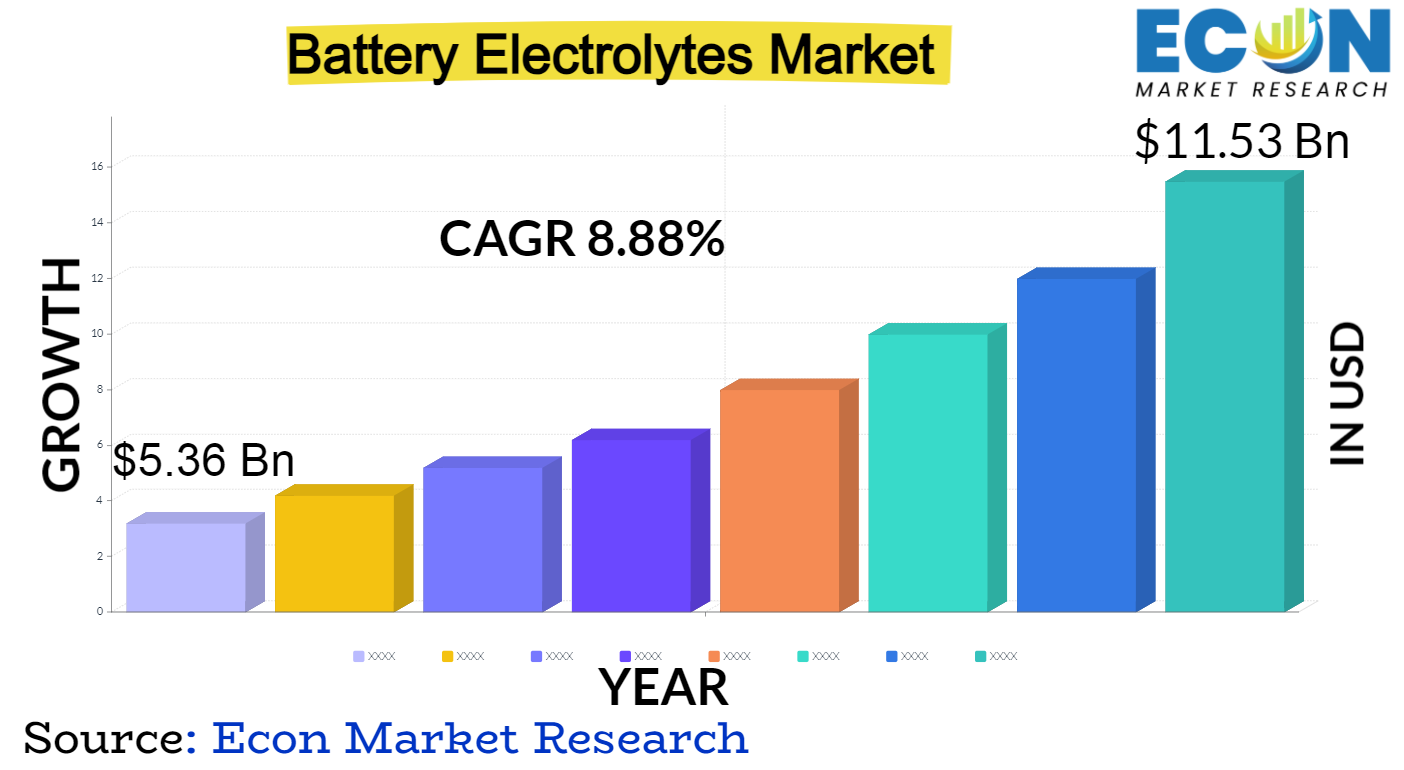

Global Battery Electrolytes market is predicted to reach approximately USD 11.53 billion by 2032, at a CAGR of 8.88% from 2024 to 2032.

The Global Battery Electrolytes Market encompasses the diverse range of electrolyte solutions vital for the operation of batteries across various industries. Electrolytes serve as the conductive medium facilitating the movement of ions between the cathode and anode within batteries, enabling the flow of electricity. With the burgeoning demand for energy storage solutions propelled by the rise of electric vehicles (EVs), renewable energy integration, and portable electronic devices, the battery electrolytes market has witnessed significant growth and innovation. Key players in the industry continuously strive to enhance electrolyte formulations, ensuring improved battery performance, safety, and longevity.

The market has seen a paradigm shift in recent years towards the creation of sophisticated electrolyte formulations, such as gel polymers, ionic liquids, and solid-state electrolytes, with the goal of resolving issues with cycle life, temperature stability, and flammability. The global market for battery electrolytes has been primarily driven by the widespread use of lithium-ion batteries (LIBs) in a variety of applications, such as consumer electronics, grid storage, and automobiles. Moreover, research and development efforts towards bio-based and non-toxic electrolyte alte atives have been boosted by the growing emphasis on sustainable and environmentally friendly solutions.

| Report Attribute | Details |

| Estimated Market Value (2023) | USD 5.36 billion |

| Projected Market Value (2032) | USD 11.53 billion |

| Base Year | 2023 |

| Forecast Years | 2024 &ndash, 2032 |

| Scope of the Report | Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment- Based on By Electrolyte Type, By Battery, &, Region. |

| Segments Covered | By Electrolyte Type, By Battery Type, &, By Region. |

| Forecast Units | Value (USD Billion or Million), and Volume (Units) |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2024 to 2032. |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East &, Africa. |

| Countries Covered | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, and South Africa, among others. |

| Report Coverage | Market growth drivers, restraints, opportunities, Porter&rsquo,s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, market attractiveness analysis by segments and region, company market share analysis. |

| Delivery Format | Delivered as an attached PDF and Excel through email, according to the purchase option. |

Battery Electrolytes Dynamics

One of the primary dynamics is the rapid expansion of the electric vehicle (EV) market, fueled by stringent emission regulations, gove ment incentives, and growing environmental consciousness. As automakers strive to develop high-performance, long-lasting batteries, the demand for advanced electrolyte solutions capable of enhancing battery efficiency, safety, and energy density continues to rise. Additionally, the increasing deployment of renewable energy sources such as solar and wind power necessitates efficient energy storage solutions, further driving the demand for battery electrolytes in grid-scale storage applications.

Market dynamics are significantly shaped by technological advancements and research initiatives, with an emphasis on creating innovative electrolyte formulations that have better cycle life, thermal stability, and compatibility with newly developed battery chemistries. Particularly, solid-state electrolytes have attracted a lot of interest as a possible replacement for traditional liquid electrolytes, providing improved safety and energy density for batteries of the future. Additionally, the market is becoming more diversified as environmentally friendly electrolyte materials made from renewable resources are adopted due to changing regulations and sustainability objectives.

Despite the promising growth prospects, the market dynamics are also influenced by challenges such as supply chain disruptions, raw material shortages, and price volatility of key components. Moreover, conce s regarding the environmental impact of battery production and disposal underscore the importance of developing recycling technologies and implementing responsible end-of-life strategies.

Battery Electrolytes Drivers

- Rapid Growth in Electric Vehicle (EV) Adoption:

The exponential rise in electric vehicle adoption worldwide is a significant driver for the battery electrolytes market. Gove ments worldwide are implementing stringent emission regulations to combat climate change, incentivizing consumers and automakers to transition towards electric vehicles. This surge in demand for EVs necessitates advanced battery technologies with higher energy density, longer cycle life, and enhanced safety features, driving the need for improved electrolyte solutions. As a result, manufacturers are investing heavily in research and development to innovate electrolyte formulations that can meet the rigorous performance requirements of EV batteries, thereby fueling market growth.

- Increasing Integration of Renewable Energy Sources:

Battery electrolytes are becoming more and more in demand as a result of the growing integration of renewable energy sources, like solar and wind power, into the electrical grid. These sources present substantial opportunities for energy storage solutions. Since the production of renewable energy is by its very nature sporadic, effective energy storage devices are necessary to store excess energy for use in times of low production or high demand.

When combined with cutting-edge electrolytes, battery storage systems give grid operators the ability to optimise the use of renewable energy sources, improve grid stability, and balance supply and demand. As a result, the adoption of battery storage solutions is accelerated by the increasing focus on decarbonisation and the shift to sustainable energy systems globally, which raises the demand for electrolyte materials.

Restraints:

- Supply Chain Disruptions and Raw Material Shortages:

Shortages of raw materials and supply chain disruptions are obstacles facing the battery electrolytes market, especially for vital components like nickel, cobalt, and lithium. The supply chain may be disrupted by changes in commodity prices, geopolitical unrest, and the depletion of essential raw material supplies, which could result in higher manufacturing costs and production delays. In addition, the concentration of raw material production in a small number of areas increases supply chain vulnerabilities, putting manufacturers at risk of both price volatility and shortages, which limits market expansion.

- Stringent Regulatory Compliance and Safety Standards:

The battery electrolytes market is subject to stringent regulatory compliance and safety standards gove ing the production, transportation, and disposal of battery materials. Regulatory frameworks aim to mitigate environmental risks, ensure product safety, and prevent hazardous incidents such as electrolyte leakage, thermal runaway, and fire hazards.

Compliance with complex regulatory requirements entails substantial investments in research, development, and testing, increasing operational costs and time-to-market for new electrolyte formulations. Additionally, evolving regulatory landscapes and divergent standards across different jurisdictions pose compliance challenges for multinational corporations, further restraining market growth.

Opportunities:

- Advancements in Solid-State Electrolytes:

The market for battery electrolytes has a lot of potential due to the development of solid-state electrolytes. Compared to traditional liquid electrolytes, solid-state electrolytes have a number of benefits, such as increased safety, greater thermal stability, and compatibility with next-generation battery chemistries like lithium-metal anodes. Mode consumer electronics, grid-scale energy storage applications, and electric vehicle manufacturers can now produce safer, higher-energy-density batteries thanks to advancements in solid-state electrolyte technology. Market participants can profit from the rising demand for cutting-edge battery technologies by allocating resources to research and development in order to commercialise affordable solid-state electrolyte solutions.

Segment Overview

- By Electrolyte Type

By Electrolyte Type, the battery market segments into Liquid, Solid, and Gel electrolytes. Liquid electrolytes are the traditional choice, consisting of solvent and dissolved salts, offering high ionic conductivity and flexibility in battery design. Solid electrolytes, on the other hand, are ga ering attention for their potential to enhance battery safety and energy density, as they mitigate risks associated with leakage and flammability common in liquid electrolytes.

Solid-state electrolytes also enable the use of lithium-metal anodes, facilitating the development of next-generation lithium batteries with higher capacity and longer cycle life. Gel electrolytes represent a hybrid approach, combining the advantages of both liquid and solid electrolytes. Gel electrolytes offer improved mechanical stability and reduced electrolyte leakage compared to traditional liquid electrolytes, making them suitable for applications requiring enhanced safety and reliability.

- By Battery Type

Battery Type segmentation categorizes batteries into Lithium-ion and Lead Acid categories. Lithium-ion batteries dominate the market due to their high energy density, long cycle life, and lightweight characteristics, making them ideal for portable electronic devices, electric vehicles, and grid-scale energy storage applications. The continuous innovation in lithium-ion battery technology, including advancements in electrode materials, electrolyte formulations, and manufacturing processes, drives the widespread adoption of lithium-ion batteries across various industries.

Lead Acid batteries, although considered a mature technology, remain prominent in automotive, industrial, and stationary backup power applications due to their low cost, reliability, and proven performance. Despite facing competition from emerging battery technologies, lead-acid batteries continue to serve niche markets where cost-effectiveness and familiarity outweigh the need for high energy density and advanced features.

Battery Electrolytes Overview by Region

Asia Pacific stands out as a dominant player, fueled by the rapid industrialization and urbanization in countries like China, Japan, and South Korea. These nations are at the forefront of the electric vehicle revolution, contributing significantly to the demand for advanced battery technologies and electrolytes. Additionally, the region',s thriving electronics industry further propels the market, with manufacturers constantly seeking high-performance battery solutions. Gove ment initiatives promoting clean energy and investments in renewable energy projects further bolster the demand for energy storage solutions, creating a conducive environment for the growth of the battery electrolytes market in Asia Pacific.

North America and Europe also play pivotal roles in the global market, driven by technological innovation, environmental awareness, and gove ment support for sustainable energy solutions. In North America, the United States is a major contributor to market growth, particularly with the increasing adoption of electric vehicles and advancements in grid-scale energy storage projects. The European market is characterized by a strong emphasis on environmental sustainability, with countries like Germany and the United Kingdom leading the transition to renewable energy sources.

The European Union',s stringent regulations on carbon emissions and initiatives promoting energy storage contribute to the demand for advanced battery electrolytes. ,In other regions, such as Latin America, the Middle East, and Africa, the market is gradually gaining traction as awareness of the benefits of energy storage and electric vehicles increases. While these regions may have a slower adoption rate compared to Asia Pacific, they present emerging opportunities for market players as infrastructure development and clean energy initiatives gain momentum.

Battery Electrolytes Market Competitive Landscape

Leading companies such as BASF SE, Mitsubishi Chemical Corporation, UBE Industries Ltd., and Solvay SA dominate the market with their extensive product portfolios and strong research and development capabilities. These industry giants focus on developing advanced electrolyte formulations tailored to meet the evolving needs of various applications, including electric vehicles, consumer electronics, and grid-scale energy storage.

Moreover, the market witnesses a significant influx of new entrants and start-ups, particularly in the solid-state electrolytes segment, driven by the increasing demand for safer and higher-performing battery technologies. These emerging players leverage disruptive technologies and novel materials to challenge established market players and capture niche segments within the battery electrolytes market. Collaborations between battery manufacturers, chemical companies, and research institutions further intensify competition, fostering innovation and accelerating the commercialization of next-generation electrolyte solutions.

Battery Electrolytes Market Leading Companies:

-

3M Company

-

NEI Corporation

-

Guangzhou Tinci Materials Technology Co., Ltd.

-

Mitsui Chemicals, Inc.

-

NOHMs Technologies Inc.

-

Shenzhen Capchem Technology Co., Ltd.

-

Targray Industries Inc.

-

UBE Industries Ltd.

-

GS Yuasa Inte ational Ltd.

-

Umicore

-

American Elements

-

BASF SE

-

Johnson Controls

-

LG Chem Ltd.

Global Battery Electrolytes Report Segmentation

| ATTRIBUTE | , , , , DETAILS |

| By Electrolyte Type |

|

| By Battery Type |

|

| By Geography |

|

| Customization Scope |

|

| Pricing |

|

,

Report Details

- Published Date2024-12-22T15:59:46

- FormatPDF

- LanguageEnglish