Automated Guided Vehicle Market

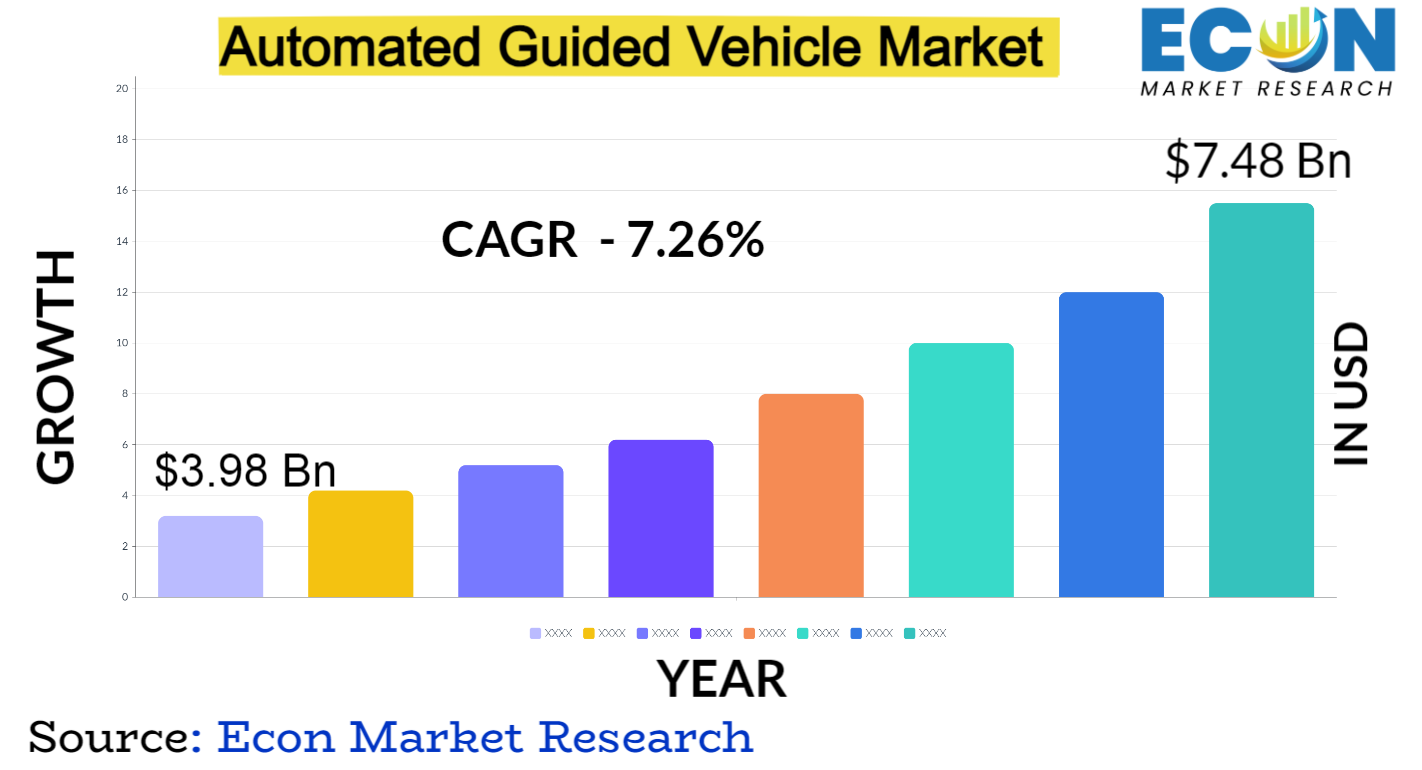

Global Automated Guided Vehicle Market is predicted to reach approximately USD 7.48 billion by 2032, at a CAGR of 7.26% from 2024 to 2032.

Autonomous mobile robots, or AGVs for short, are computer-driven vehicles that are intended to move materials or products around a facility autonomously, requiring no human assistance. These cars can navigate through predetermined routes and avoid obstacles thanks to the sensors, cameras, and navigation systems installed in them. AGVs are primarily intended to improve workflow processes, lower labour costs, and increase operational efficiency.

The market for AGVs is expanding rapidly in a number of industries, including manufacturing, logistics, healthcare, and retail. AGVs are being used by businesses more frequently to increase productivity, manage inventories better, and simplify inte al logistics. The creation and implementation of sophisticated AGV systems have been expedited by the incorporation of Industry 4.0 concepts, such as artificial intelligence and the Inte et of Things (IoT). Major industry participants are concentrating on advancements in real-time data analytics, machine lea ing algorithms, and sensor technologies to give AGVs better capabilities, such as increased decision-making and flexibility in changing environments.

Automated Guided Vehicle Report Scope and Segmentation

| Report Attribute | Details |

| Estimated Market Value (2023) | USD 3.98 billion |

| Projected Market Value (2032) | USD 7.48 billion |

| Base Year | 2023 |

| Forecast Years | 2024 &ndash, 2032 |

| Scope of the Report | Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment- Based on By Type, By Navigation Technology, End-User, Application &, Region. |

| Segments Covered | By Type, By Navigation Technology, End-User, Application &, By Region. |

| Forecast Units | Value (USD Billion or Million), and Volume (Units) |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2024 to 2032. |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East &, Africa. |

| Countries Covered | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, and South Africa, among others. |

| Report Coverage | Market growth drivers, restraints, opportunities, Porter&rsquo,s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, market attractiveness analysis by segments and region, company market share analysis. |

| Delivery Format | Delivered as an attached PDF and Excel through email, according to the purchase option. |

Automated Guided Vehicle Dynamics

The ongoing incorporation of cutting-edge technologies like sensor systems, artificial intelligence, and machine lea ing into AGV designs is one important motivator. These developments improve the vehicles', capabilities, enabling more advanced navigation, environment adaptability, and better decision-making. The AGV market dynamics are significantly shaped by the Industry 4.0 paradigm, which is characterised by the convergence of digital technologies and physical systems. This paradigm fosters interconnected and intelligent manufacturing processes.

The increasing emphasis on cost reduction and operational optimization acts as a catalyst for AGV adoption, particularly in sectors where material handling and logistics efficiency are critical. The COVID-19 pandemic has further accelerated the demand for automation solutions, driven by the need for contactless operations and supply chain resilience. As industries strive to mitigate labor shortages, enhance workplace safety, and address logistics challenges, the AGV market is positioned for substantial growth. Additionally, the market dynamics are influenced by the rising awareness among end-users about the benefits of AGVs in improving productivity, reducing errors, and minimizing operational downtime. Amidst this dynamic landscape, market players are engaged in continuous research and development to introduce innovative AGV solutions that cater to evolving industry demands, ensuring that the market remains at the forefront of technological innovation and industrial transformation.

Automated Guided Vehicle Drivers

- Technological Advancements and Industry 4.0 Integration

Automation, machine lea ing, artificial intelligence, and sensor systems are just a few examples of the technologies that are constantly developing and driving the Automated Guided Vehicle (AGV) market. AGVs are essential to the automation of material handling in ",smart factories,", which are the product of manufacturing processes incorporating Industry 4.0 concepts. The capabilities of AGVs are increased by advanced technologies, which allow adaptive navigation, real-time data analytics, and better decision-making. The market for intelligent and connected AGV solutions is anticipated to grow as more industries embrace digital transformation.

- Rising Emphasis on Operational Efficiency and Cost Reduction

Adoption of AGVs is significantly influenced by the ongoing emphasis on cost containment and operational efficiency across industries. AGVs reduce the need for manual labour and error-prone material handling procedures by providing automated and streamlined processes. Enhanced productivity is a result of AGVs', capacity to function around-the-clock, navigate intricate environments, and optimise workflows. AGVs are becoming more and more popular among industries looking to increase overall operational efficiency, especially in manufacturing and logistics, as a strategic way to cut costs and boost competitiveness in the global market.

Restraints:

The somewhat high initial cost of installing AGV systems is a significant barrier to the AGV market. In addition to the price of the AGV hardware, the cost also covers costs related to software development, system integration, and staff training. Widespread adoption may be impeded by small and medium-sized enterprises', (SMEs) inability to afford the initial capital outlay. Overcoming this limitation will require addressing financial issues and creating more affordable AGV solutions.

- Limited Flexibility in Dynamic Environments

AGVs operate optimally in controlled and predefined environments, however, their effectiveness may be limited in highly dynamic or unpredictable settings. The rigid nature of preprogramed routes and reliance on infrastructure such as magnetic strips or markers can pose challenges in facilities with frequent layout changes or irregular workflows. Adapting AGV systems to handle unpredictable scenarios, diverse tasks, and rapid changes in production requirements is a critical challenge that needs to be addressed to broaden the applicability of AGVs across various industries.

Opportunities:

- Development of Hybrid and Collaborative AGV Systems

The opportunity lies in the development of hybrid and collaborative AGV systems that combine the strengths of traditional AGVs with human-operated tasks. Collaborative robots, or cobots, can work alongside human workers, handling tasks that require dexterity and adaptability. Integrating collaborative features into AGVs opens new possibilities for applications in industries where human-robot collaboration is essential, such as assembly lines and complex manufacturing processes. Creating flexible and adaptable AGV systems that seamlessly collaborate with human workers can unlock new opportunities in diverse industries, expanding the market',s scope beyond traditional material handling applications.

Segment Overview

- By Type

Based on their main uses, the Automated Guided Vehicle (AGV) market is segmented by type, placing these vehicles into discrete functional groups. Tow trucks are made to tow several loads at once, whereas unit load carriers concentrate on the effective transportation of a single large item. In industrial settings, pallet trucks and forklift trucks are essential for lifting and moving large loads. Assembling line vehicles perform tasks along assembly lines and help automate manufacturing processes. The ",Others", category encompasses specialized AGVs tailored for unique applications, showcasing the versatility of AGV solutions in addressing diverse industry requirements. This segmentation ensures that AGVs are strategically deployed based on specific operational needs, providing targeted solutions across a spectrum of industries.

- By Navigation Technology

AGVs are categorised in the navigation technology segment according to the guidance systems they use for self-movement. To help AGVs navigate, laser guidance uses lasers to map the surrounding area. Cameras and image processing are used by vision guidance to interpret its environment. Embedded magnets are used in magnetic guidance to provide accurate navigation. With inductive guidance, precise positioning is ensured by using sensors to follow magnetic fields. Optical tape guidance relies on visual markers for navigation. The ",Others", category encompasses emerging technologies or combinations of existing ones. This segmentation highlights the diverse technological approaches employed by AGVs, allowing industries to choose systems that best align with their operational requirements and facility infrastructure.

- By End-User

The end-user segmentation identifies the industries benefiting from AGV applications. Automotive industries employ AGVs for material transportation and assembly line tasks. Manufacturing sectors utilize AGVs for various material handling and logistics operations. AGVs play a crucial role in enhancing efficiency within the food and beverage industry, ensuring timely and accurate movement of goods. Healthcare facilities leverage AGVs for inte al logistics, supporting tasks such as medication delivery and equipment transport. Logistics and warehousing sectors extensively use AGVs for inventory management and order fulfillment. The aerospace industry employs AGVs for material transportation and assembly line processes. Retail sectors benefit from AGVs for inventory management and order processing.

- By Application

AGV use cases are categorised in the application segment according to particular operational tasks. AGVs with material handling capabilities are adaptable vehicles used for moving cargo inside of a building. Assembly line AGVs manage tasks along assembly lines, which helps automate manufacturing processes. AGVs for warehouse management efficiently move and arrange inventory, which improves logistics operations.

The purpose of tugger AGVs is to move carts or trailers, making material transportation in production or distribution environments more efficient. The main function of forklift AGVs is to lift and move large loads. The ",Others", category comprises AGV applications designed to meet specific and changing industry requirements. This division highlights the diverse range of uses for AGVs, demonstrating their flexibility in a variety of operational contexts.

Automated Guided Vehicle Overview by Region

North America is a prominent player in the AGV market, driven by the region',s early adoption of advanced technologies, particularly in the automotive and e-commerce sectors. The presence of established manufacturing facilities, coupled with a strong emphasis on automation and Industry 4.0 practices, fuels the demand for AGVs.

In Europe, the AGV market is propelled by the manufacturing prowess of countries such as Germany, coupled with stringent regulations promoting workplace safety. The region witnesses a significant uptake of AGVs in logistics and warehousing, aligning with the growing e-commerce trends. Meanwhile, the Asia-Pacific region emerges as a key growth hub, led by rapid industrialization in countries like China and Japan. Increasing investments in smart manufacturing and the expanding automotive sector contribute to the substantial demand for AGVs.

Automated Guided Vehicle Market Competitive Landscape

Well-known businesses with a wide range of vehicle types and navigation technologies, like Daifuku Co., Ltd., KION Group, and Toyota Industries Corporation, dominate the market for comprehensive AGV solutions. These massive corporations in the industry use their global reach and vast R&,D resources to launch state-of-the-art AGV systems that are customised for different industries, promoting automation and efficiency.

Furthermore, newcomers such as Seegrid Corporation and Fetch Robotics add to the competitive landscape by emphasising adaptable and agile AGV solutions that meet the changing demands of contemporary logistics and manufacturing. These businesses frequently place a strong emphasis on cooperative and approachable designs, enhancing AGV capabilities by integrating cutting-edge technologies like artificial intelligence and machine lea ing.

Automated Guided Vehicle Market Leading Companies:

-

Daifuku Co., Ltd.

-

JBT Corporation

-

KUKA AG

-

Toyota Material Handling

-

Hyster-Yale Materials Handling, Inc.

-

Seegrid Corporation

-

Swisslog Holding AG

-

Bastian Solutions, LLC

-

BALYO

Automated Guided Vehicle Recent Developments

- Sept 2023, Align Production Systems, a prominent pioneer in material handling systems, has revealed a strategic alliance with Kollmorgen, renowned for its expertise in vehicle control products. The collaboration, as stated by the companies, aims to ",transform", automated guided vehicles (AGVs).

- Feb 2023, Murata Machinery USA, Inc. broadens its range of logistics and automation products by introducing a comprehensive selection of automated guided vehicles (AGVs). The A-Series introduces seven standard base models to complement their existing Muratec Premex Series. These models are adaptable for various load capacities, lift heights, navigation methods, temperature ratings, and software applications.

- June 2023, Mitsubishi Logisnext Americas and Jungheinrich are set to broaden their collaborative efforts in North America by extending their joint venture into the realm of mobile automation solutions. This expansion will see the establishment of a new entity named Rocrich AGV Solutions. ,

Global Automated Guided Vehicle Report Segmentation

| ATTRIBUTE | , , , , ,DETAILS |

| By Type |

|

| By Navigation Technology |

|

| By End-User |

|

| By Application |

|

| By Geography |

|

| Customization Scope |

|

| Pricing |

|

,

Report Details

- Published Date2024-12-22T15:59:46

- FormatPDF

- LanguageEnglish