Agriculture Supply Chain Management Market

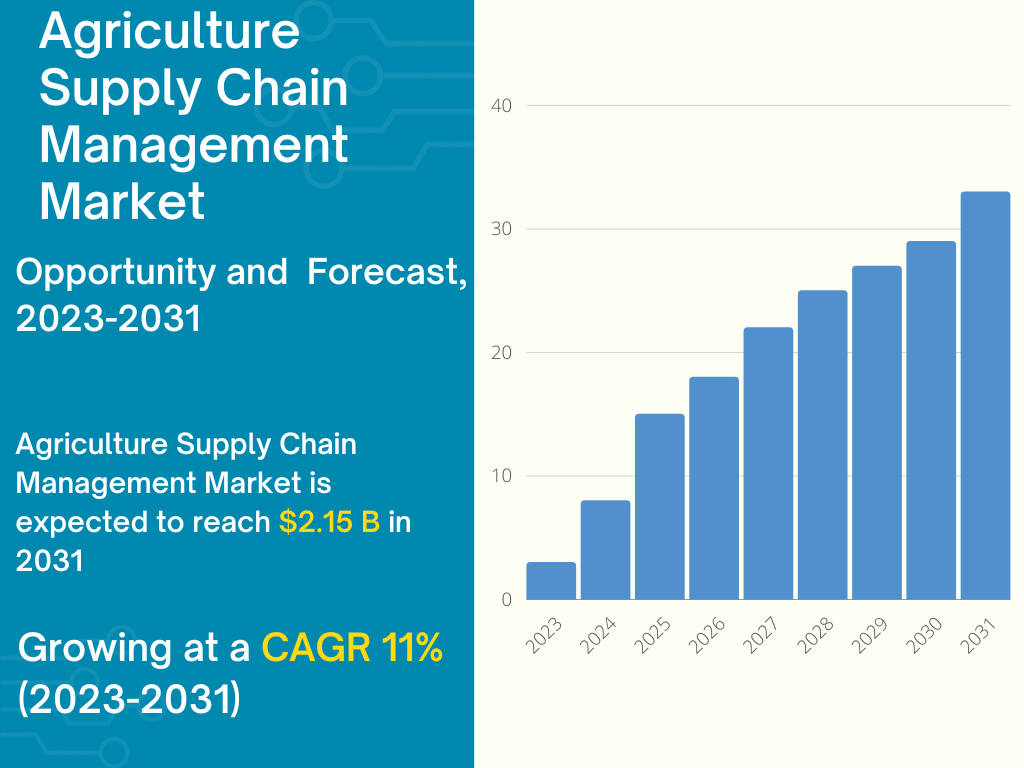

The Global Agriculture Supply Chain Management Market size was exhibited at USD 0.83 billion in 2022 and is expected to hit around USD 2.15 billion by 2031, growing at a compound annual growth rate (CAGR) of 11% during the forecast period 2023-2031.

Supply chain management manages the flow of goods and services and includes all processes that transform raw materials into final products. Similar to this, agriculture supply chain management entails controlling interactions between businesses in charge of efficiently producing and delivering goods from farms to consumers in order to consistently meet their demands for quantity, quality, and price. This typically entails overseeing procedures, partnerships, and horizontal and vertical alliances. Hence, to ensure that production and delivery commitments are met on time, agricultural supply chains implement inte al controls and provide chain-wide incentives. Although the rise of supply chains from the farm gate to the retail level has been facilitated by improved efficiency, timely distribution, cost-effective transportation, and product differentiation. For instance, in May 2022, Intellync announced a cooperation with supply chain management solution provider Star Index in order to combine Star Index',s extensive knowledge of supply chain insights with Intellync',s expertise in agricultural supply chains. It creates software that will help agri-food companies enhance their supply chains by reducing resource needs, assessing risk, and capturing and reporting data.

,

COVID-19 Impact on Agriculture Supply Chain Management Market

The COVID-19 epidemic has a negative influence on the global market for supply chain management in agriculture. Due to a lack of supplies from other states, problems with the arrangement of the transport vehicles, transportation restrictions, labour shortages, ineffective cold chain facilities, panic buying, price fluctuations, and a lack of collectors/aggregators in the market, it has caused disruptions in the agricultural supply chain. Also, due to constraints on inte ational trade, the pandemic has impacted the export and import of agricultural products globally. The management of the global agriculture supply chain has been harmed by all of these operations.

The market',s stakeholders are, however, making the necessary preparations to make up for the loss brought on by the pandemic. Also, it is expected that businesses will put more of an emphasis on post-pandemic solutions that will help advanced preparation and lessen the effects of such crises in the future. In the coming years, the organizations will place a greater emphasis on end-to-end stock visibility, intricate supplier monitoring, and process automation, which will increase demand for SCM software in the agriculture supply chain management sector.

Agriculture Supply Chain Management Market REPORT SCOPE &, SEGMENTATION

| Report Attribute | Details |

| Projected Market Value (2031) | 2.15 billion |

| Estimated Market Value (2022) | 0.83 billion |

| Base Year | 2022 |

| Forecast Years | 2023 - 2031 |

| Scope of the Report | Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment- By Component, By Solution type, By Deployment model, By User type, and Region |

| Segments Covered | By Component, By Solution type, By Deployment model, By User type, and Region |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2023 to 2031 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East &, Africa, and Rest of World |

| Countries Covered | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, and South Africa, among others |

| Report Coverage | Market growth drivers, restraints, opportunities, Porter&rsquo,s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, market attractiveness analysis by segments and region, company market share analysis, and COVID-19 impact analysis. |

| Delivery Format | Delivered as an attached PDF and Excel through email, according to the purchase option. |

Market Dynamics

Market Drivers

The worldwide agriculture supply chain industry will develop due to cloud-based software - Agricultural demand and supply chain operations have recently seen a continuous increase in the use of cloud-based applications. A supply chain that is located in the cloud benefits consumers in many ways. When several cloud vendors enhance their portfolios, the overall cost of solutions is significantly reduced. Organizations headquartered in agriculture can benefit from a variety of factors, including reduced risk, more visibility, quicker deployment, and greater flexibility.

Market Restraints

- High cost to restraint the growth of the global agriculture supply chain market- The price of using an agricultural supply chain management system adds to the cost of the finished commodity that is supplied. Small-scale industries frequently lack the budget since processing information and coordinating transactions between businesses is significantly more expensive.

- Extended time for installation - The delivery procedure is hampered by the receiver',s uncertainty caused by the lengthy software installation and implementation times. The lengthening of these processes adds overhead expenses as well, which has a negative effect on the final cost of agricultural products.

Market Opportunities

- Increasing demand for enhanced supply chain visibility - The status of numerous operations carried out by agricultural supply chain management systems is tracked in real-time by supply chain managers. Supply chain managers can be ready and handle little issues that develop because of this ongoing monitoring. The ongoing observation ensures sufficient production and supply of goods from the producer to the consumer. The system aids in maintaining the quantity, quality, and price requirements for the items.

Regional Analysis

On the basis of regional analysis, the Global Agriculture Supply Chain Management Market is classified into four regions: North America, Europe, Asia Pacific, and the Rest of the World. North America accounted for the largest market share, and Europe was the second largest in 2022. Market consolidation with larger companies acquiring smaller competitors to attain economies of scale and vertical integration, the trend of precision farming, and increased investments in agritech start-ups are some of the important factors driving the growth of the North American market. Agri inputs, precision agriculture, farm management software, supply chain technology, quality management, and traceability are among the major advancement areas in the North American agriculture sector that are driving technology adoption.

Competitive Landscape

The key market players profiled in the report include:

- FCE Group AG

- Agri Value Chain

- Bext360

- Ambrosus

- ChainPoint

- AgriDigital

- eHarvestHub

- Eka

- GrainChain, Inc.

- Geora Ltd.

- IBM

- Trellis Ltd.

- Intellync

- SAP SE

- Proagrica

The companies have adopted organic as well as inorganic growth strategies, such as new service and product developments and investments and expansions, to expand their product portfolios and increase their respective market shares across different regions. Expansion and investments involve investments in R&,D, new manufacturing facilities, and supply chain optimization.

Agriculture Supply Chain Management Market Report Segmentation

| ATTRIBUTE | DETAILS |

| By Component |

|

| By Solution Type |

|

| By Deployment Model |

|

| By User Type |

|

| By Geography |

|

| Customization Scope |

|

| Pricing |

|

FAQs

Report Details

- Last UpdatedJanuary 29, 2026

- FormatPDF

- LanguageEnglish